The recently released April Revenue and Economic Update gave us good news about the state’s economic and budget landscape. The quarterly report from Minnesota Management and Budget (MMB) showed that the most recent state revenues have come in slightly above projections, and that the national economy is now expected to grow a little more slowly this year and slightly faster next year.

Some of the top takeaways from the update include:

1. State revenues are coming slightly above projections. The state’s revenues for February and March came in $84 million above projections; that’s 3.2 percent more than projected in the state’s February 2019 Economic Forecast. The slight increase is primarily due to higher income taxes received. The Update notes that the state will have a fuller picture of total tax year 2018 income tax payments later in April.

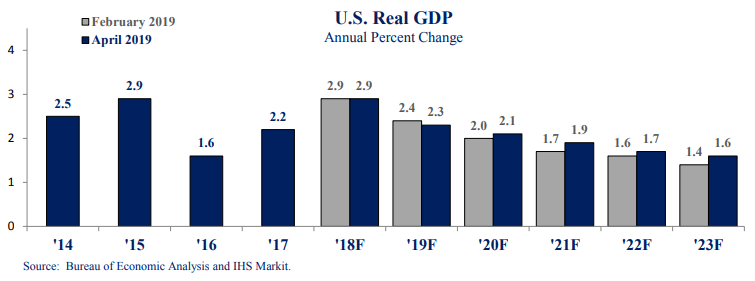

2. Overall, future national economic growth is expected to be just above February forecast projections. For this year, economic growth is expected to be slightly slower than earlier predicted. The economic forecasters predict 2.3 percent national GDP growth for 2019. In 2020 and beyond, national economic growth is still expected to grow at a slow pace – but it is now expected to grow slightly faster than predicted in February.

3. National unemployment rate expected to remain low. The U.S. unemployment rate has been holding steady at 3.8 percent. It is expected to drop to 3.6 percent in 2019, before creeping back up in 2020. The Update reports that labor force participation has increased very slightly since a year ago, and recent job growth has been above the monthly average.

4. Forecasters are fairly confident in their projections, but give higher likelihood that things will be worse rather than better. The forecasters assign a 60 percent chance that their baseline forecast is correct. They also give a 30 percent chance for a more pessimistic scenario and assign a 10 percent probability to a more optimistic scenario.

This new Update tells us some good news, but not much has changed since the February forecast. With such slow projected economic growth, the national economy is less resilient, and any sudden shocks to the economy could turn into a recession. This Update points to the importance of the budget reserve the state has built up to prepare for the next economic downturn. It also demonstrates the importance of protecting funding sources for services that Minnesotans count on, including by maintaining the provider tax. This major funding source for affordable health care will expire on January 1, 2020, if policymakers don’t act, resulting in the loss of about $700 million per year in funding for affordable health care and healthy communities.

This is the last quarterly revenue update that policymakers will get before the legislative session ends in May. As they work toward the tax and budget decisions they will enact this year, they should prioritize sustainable revenues that fund quality education, health care, child care, roadways, and transit that reach every community across the state.