This fall, the state’s November Budget and Economic Forecast projected a slight state budget deficit for the remainder of the FY 2018-19 budget cycle. Some pointed to the state’s budget reserve as a possible solution for balancing the budget. Last year, state policymakers tapped into the state’s budget reserve to fund health insurance premium assistance.

For the budget reserve to actually function as the state’s rainy day fund, the reserve has to be allowed to build up so that those funds will be there when they’re really needed. In these uncertain times, here are some thoughts on the importance of a strong budget reserve, and why policymakers shouldn’t be too quick to tap into it.

- Decisions around using the budget reserve should take into consideration more than just budgetary projections. That’s not just our opinion. The Minnesota statute on budget reserves notes that, “The use of the budget reserve should be governed by principles based on the full economic cycle rather than the budget cycle.” Right now, the United States is in its ninth year of economic expansion since the last recession. This is uncommonly long, and given the length of the current economic recovery, it’s likely that the next recession isn’t too far away.

- During a recession, the needs of Minnesotans grow – just at the time that the resources our state relies on to meet those needs shrink. In the same way a family might save to be able to make it through a long illness or job loss, Minnesota keeps its reserve so when a recession hits, the state can avoid drastic cuts in essential services and continue to serve Minnesotans’ needs.

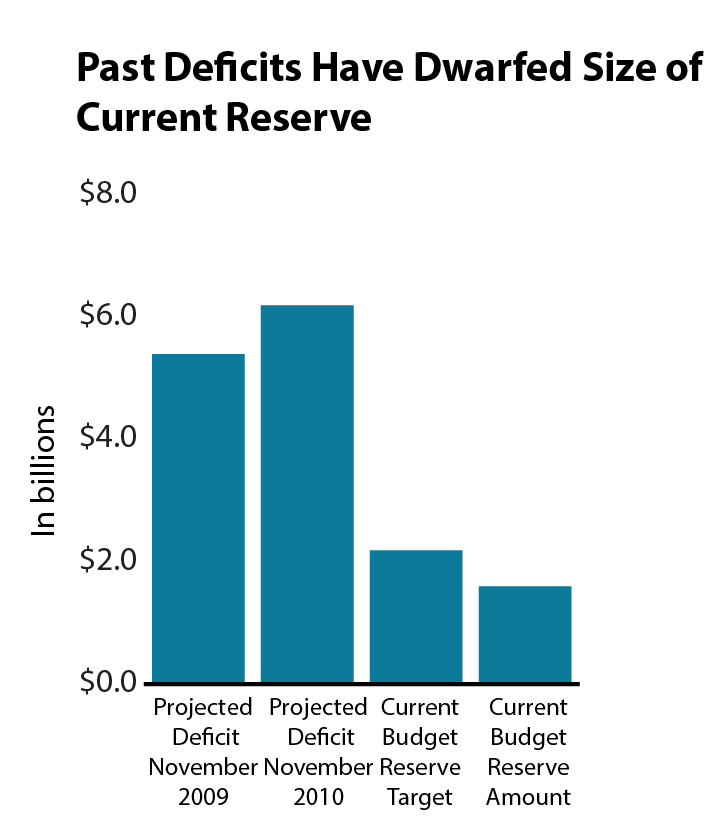

- Past deficits during recessions have dwarfed the amount currently in our budget reserve. Every year Minnesota Management and Budget sets a goal for the budget reserve that would get the state through most recessions. However, we haven’t saved that much yet, and past recessions have created deficits that were much larger than the current reserve.

- A healthy level of reserves gives policymakers the time they need to make responsible and thoughtful budget choices. Reserves provide a financial cushion to respond to budget shocks, whether in response to tough economic times or other dramatic changes. For example, federal policymakers have put forward proposals that would fundamentally weaken federal-state partnerships, reducing federal funding and shifting responsibilities to the states in areas as diverse as food assistance to health care. Should such proposals pass, Minnesota could need to identify and implement other ways of funding essential services, and reserves can help bridge a funding gap during the transition.

Building strong budget reserves is one important tool to put our state in a strong position to respond to future economic downturns or big federal budget changes. In contrast, moving too quickly to tap into the budget reserve won’t set us up for success in the future.

By Clark Goldenrod