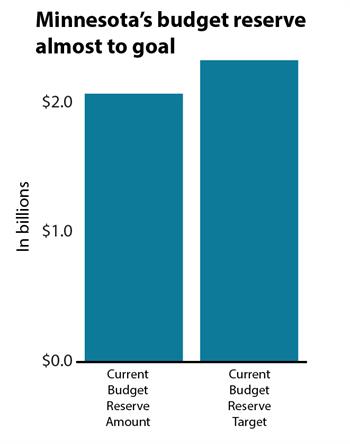

Every year, Minnesota Management and Budget gives Minnesotans an estimate of what the state needs in its “rainy day” fund to weather a sudden drop in revenues like we might see in a recession. The latest report brought us some good news. The state is now almost 90 percent of the way to the recommended level for the budget reserve.

Minnesota Management and Budget now recommends a budget reserve of $2.3 billion, or 4.9 percent of the state’s biennial general fund revenues. They come to this figure by evaluating the stability of the state’s revenues, and then put forth a number that they are fairly confident would exceed most deficits when the economy takes a turn.

Minnesota builds its budget reserve so that when a recession hits and state revenues plummet, the state can avoid drastic cuts in critical services and continue to serve Minnesotans’ needs as they strive to get through tough times. When state revenues plunged during the Great Recession, many states, including Minnesota, needed to tap into their savings to get by, much like a family would. Rainy day funds, such as budget reserves, helped states avoid $20 billion in cuts during the last recession, including cuts to services that people rely on during economic downturns. But even with those reserves, states ultimately made cuts in higher education, K-12 education, services for the elderly and people living with disabilities, and more.

Thanks to several years of responsibly adding to the state’s budget reserve, Minnesota’s rainy day fund is the strongest it’s ever been, and that’s great news for Minnesotans. However, in the 2019 Legislative Session, policymakers decided to weaken the reserve by taking nearly $500 million out on July 1, 2021, in order to help balance the future budget. This would deplete almost a quarter of the reserve’s balance, and is an especially risky move considering the last several state economic updates have indicated a possible recession in the near future. The October Economic Update gave a 35 percent chance for an economic scenario in which there’s a short recession in 2020. This means that the scheduled withdrawal could happen at a time when the state may most need its budget reserve to meet the needs of Minnesotans.

Policymakers have done some important, hard work to build the state’s budget reserve. During the 2020 Legislative Session, Minnesota policymakers should prepare for the future by prioritizing building on that work and strengthen the budget reserve further.