A healthy budget reserve is a two-for-one deal for states, according to a new report from the Center for American Progress. When states craft responsible policies that build their budget reserves, they are better able to support their residents during an economic downturn and are able to enact progressive tax policies.

A strong budget reserve helps a state and its residents make ends meet in tough economic times. When state revenues plunged during the Great Recession, many states, including Minnesota, needed to tap into their savings to get by, much like a family would. Even with those savings, states across the U.S. ultimately made cuts in higher education, K-12, services for the elderly and people with disabilities and more. However, the report notes that “rainy day” funds, such as budget reserves, helped states avoid $20 billion in cuts during the recession including cuts to services that people rely on during economic downturns.

A strong budget reserve also enables states to build progressive tax systems. Currently, all U.S. states, including Minnesota, have regressive tax systems, meaning that low-income households pay a higher percentage of their income in taxes than high-income households. This is due in part to states choosing to rely more on certain revenue sources, like property taxes, that are relatively stable no matter the state of the economy. Unfortunately, these taxes also require low-income households to pay more than their fair share in taxes. With strong budget reserves, states can move toward equitable tax systems and absorb some fluctuation in revenue collections. We’ve seen how Minnesota has started in this direction, both in making tax changes that made our state tax system less regressive and in strengthening our budget reserve.

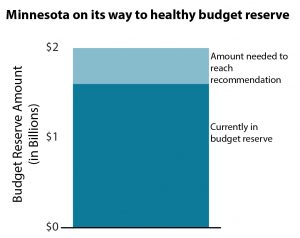

Minnesota Management and Budget (MMB) annually projects how much the state needs in savings to adequately prepare for downturns in the business cycle, based on factors like state revenue volatility. Their latest Budget Reserve Report recommended a target of 4.8 percent of general tax revenues, or $2.0 billion. Currently, the state has $1.6 billion in its reserve, or about three-quarters of the recommended target.

This stronger reserve amount is due to smart policy changes made in the 2014 Legislative Session, requiring that up to one-third of any positive balance in a November forecast go to the budget reserve until it reaches MMB’s recommended amount.

It’s important to continue building the state’s budget reserve to soften the shock of inevitable economic downturns and better meet the needs of Minnesotans during tough times. As Minnesota builds its reserve, policymakers should also continue its progress toward a more equitable tax system.