In recent years, Minnesota has taken important steps to build up the state’s budget reserve. And thanks to this good work, the state has almost reached its reserve target of $2.1 billion.

But even as we’re building a strong budget reserve, some policymakers have suggested weakening the state’s rainy day fund. This is a mistake. A robust budget reserve is a critical part of adequately preparing for the next economic downturn. In the same way a family saves to withstand an unexpected serious illness or job loss, Minnesota builds this reserve so that when a recession hits, the state can avoid drastic cuts in critical services and continue to serve Minnesotans’ needs.

Adequate budget reserves are essential for states because their balanced budget requirements put them in a challenging position in a recession: the needs of their residents grow at exactly the same time as the resources to meet those needs are shrinking.

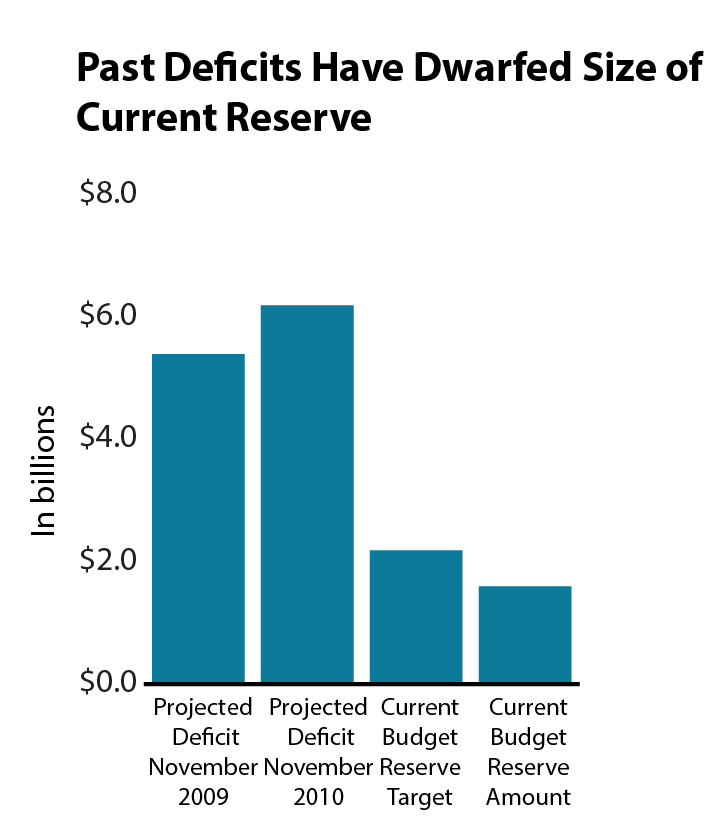

While the state currently projects a $1.4 billion positive balance for the upcoming FY 2018-19 budget cycle, the story was very different only a few years ago. Just six years ago, the state faced a $6.2 billion deficit for FY 2012-13. That’s three times what we currently have in our budget reserve. Policymakers made painful cuts, including in financial aid for college, nursing homes and other services for seniors, and services for Minnesotans with disabilities, that made it even harder for struggling Minnesotans to weather the recession.

Minnesota had a much smaller budget reserve at that time. The one we’re building today will be able to shield struggling Minnesotans from many cuts. Minnesota Management and Budget currently recommends a reserve that is 4.9 percent of general fund revenues. A reserve of this size would well prepare the state to absorb the shock of 95 percent of future economic downturns. Additionally, a healthy level of reserves will afford state policymakers the time they need to make more responsible tax and budget choices in tough economic times, instead of having to make hasty decisions to balance the budget.

Experts agree that a strong budget reserve makes for responsible budgeting. The state’s Council of Economic Advisers, The Pew Charitable Trusts, and credit ratings agencies all speak to the importance of strong reserves. Maintaining a healthy reserve also helps keep a positive credit rating because it can show the state has strong fiscal management. Rating agencies Standard and Poor’s and Moody’s look for budget reserves of 4 and 5 percent respectively. A strong credit rating means lower costs in maintaining our infrastructure, including building and repairing our roads, bridges, schools and libraries; and preserving our historic places.

It’s imperative to build and maintain a strong budget reserve when the state’s budget outlook is good, and Minnesota has made laudable progress. But with many economists estimating that the next recession might not be too far away, policymakers shouldn’t jeopardize the well-being of struggling Minnesotans and the state’s fiscal health by weakening our rainy day savings.

By Clark Biegler