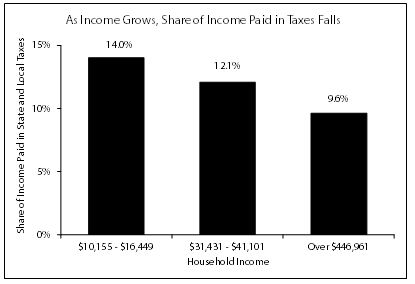

A national report confirms what many Minnesotans already know: Minnesota’s tax system does not share the responsibility for funding public services fairly. The Minnesotans with the highest incomes pay the smallest share of their incomes in state and local taxes.

Who Pays? by the Institute on Taxation and Economic Policy (ITEP) emphasizes that fairness in state tax systems depends on how much the state relies on income, property, and consumption (sales and excise) taxes.

State income taxes normally are progressive – the amount of tax rises as income goes up. Property taxes and sales taxes, in contrast, are regressive – low- and middle-income people pay a higher share of their incomes in those taxes than those with high incomes. How a state structures these taxes also has an impact.

ITEP commends Minnesota for several positive features of our tax system, including having a graduated income tax rate structure, our property tax refund for homeowners and renters, and our state EITC, the Working Family Credit. These refundable credits offset some of the impact of regressive property and sales taxes.

ITEP notes that a relatively high sales tax rate and narrow sales tax base are regressive features of Minnesota’s tax system. And they highlight recent cuts in the property tax refund for renters, a policy decision that worsens regressivity.

There is more to do to improve tax fairness in Minnesota and narrow the gap between what the highest-income Minnesotans pay and what average Minnesotans pay, such as:

- Focusing income tax increases on the highest-income Minnesotans;

- Improving the state’s property tax refund for renters (the Renters’ Credit;

- Leveling the playing field by requiring Internet retailers to collect sales taxes on purchases by state residents.

Several of these options are in Governor Dayton’s tax reform plan, which seeks to make the tax system more fair, end the cycle of deficits and invest in the state’s future.

For those who would wish to emulate “low-tax” states, the ITEP report has a warning: many “low-tax” states are high-tax states for low- and middle-income families.