In an era of income inequality and growing concentration of wealth, a new 50-state study released today analyzes whether state tax systems make income inequality better or worse. The Institute on Taxation and Economic Policy (ITEP) finds that nearly every state fails basic measures of fairness, but Minnesota is among a small number of states where income inequality is reduced by state tax policy.

In their Who Pays? report, ITEP highlights a number of things that Minnesota does right to build a fairer tax system. These include:

- A graduated personal income tax;

- Targeted tax credits including the Working Family Credit, Property Tax Refunds for homeowners and renters, and the Child and Dependent Care Credit;

- Having an estate tax; and

- Excluding groceries from the sales tax.

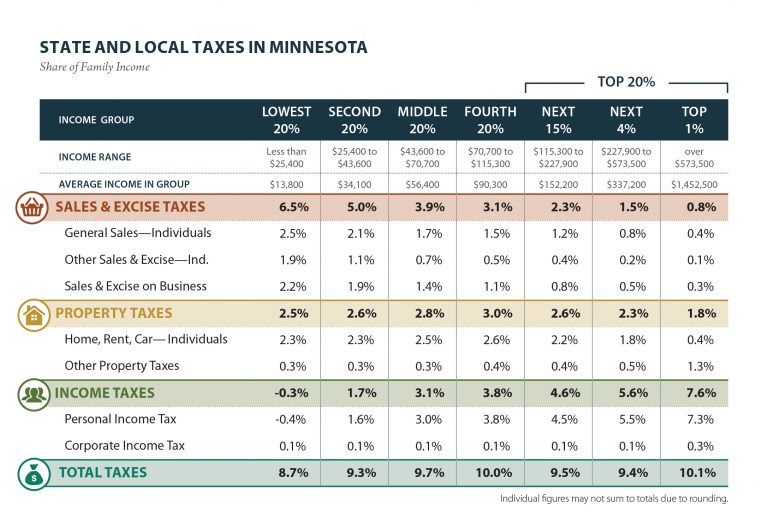

In addition to their tax inequality index, ITEP evaluates states on what share of their incomes households of different income levels pay in taxes. It finds that nearly every state has an upside-down tax system in which low- and middle-income families pay a higher share of their incomes in state and local taxes than the wealthy. In other words, their tax systems are regressive.

Minnesota does a lot of things well, and the ITEP report points out ways we can build on this momentum. This would include expanding the Working Family Credit, with particular attention to improving the credit for workers without dependent children, who benefit much less from the credit as it is currently structured.

As policymakers debate whether and how to conform our state’s tax laws to the 2017 federal changes, they should make smart decisions that protect Minnesota’s tax fairness. For example, they should not conform to federal tax changes that would mean smaller state Property Tax Refunds for seniors, people living with disabilities, and families with dependents.

Policymakers should also reject lopsided tax cut proposals that would provide little benefit to struggling families while doing more for high-income households. For example, the 2018 legislative tax proposal included income tax rate reductions that would do nothing for an estimated 1 in 5 Minnesota households with lower incomes. As the ITEP report reminds us, while Minnesotans at all income levels pay roughly similar shares of their incomes in total state and local taxes, income taxes have a smaller impact on low- and moderate-income households. For these Minnesotans, sales taxes and property taxes make up a larger share of their total tax responsibility.

ITEP’s report also paints a picture of what happens on the other side of the spectrum, in the “Terrible Ten” states with the most regressive tax systems. In states such as Washington, Texas, Florida, and South Dakota, low- and middle-income residents pay substantially higher shares of their incomes in state and local taxes than the wealthy.

ITEP notes that, in addition to exacerbating income inequality, unfair tax systems are unsustainable. When much of the income growth goes to high-income households, state tax systems that rely more heavily on taxing low- and middle-income residents struggle to raise enough revenue to fund their children’s education, parks and public spaces, infrastructure, and other basic services.

Minnesota has taken another path, one that has paid off for the residents of our state and that other states could follow. As Meg Wiehe, deputy director of ITEP and an author of the study notes, “Inequitable state tax systems don’t have to be a foregone conclusion…Tax policy should be used as a tool to help mitigate income disparities rather than to drive a wider divide.”