As part of the final budget agreement, Minnesota’s policymakers decided to take money out of the state’s rainy day fund. This was an irresponsible budgeting choice that could hurt struggling Minnesotans during the next recession.

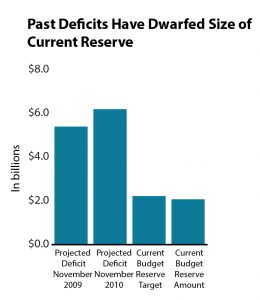

After years of sound fiscal policy, the state’s budget reserve is at nearly $2.1 billion, and is just shy of the 5 percent of general fund revenues that Minnesota Management and Budget currently recommends. A robust budget reserve is a critical part of adequately preparing for the next economic downturn. In the same way a family saves to withstand an unexpected serious illness or job loss, Minnesota builds this reserve so that when a recession hits and state revenues plummet, the state can avoid drastic cuts in critical services and continue to serve Minnesotans’ needs. However, the budget agreement would withdraw $491 million in FY 2022-23, weakening the reserve.

Here are a few reasons why this was a bad move:

- Decisions around using the budget reserve should take into consideration the full economic cycle. The United States has had 10 years of economic growth since the last recession. This is uncommonly long, and along with recent projections of slowing economic growth, it’s likely that the next recession isn’t too far away.

- When the next recession hits, the needs of Minnesotans will grow – at the same time that the state’s resources will shrink. The state’s current reserve is not yet to the recommended level to address a common-sized economic downturn and is well short of the types of deficits Minnesota has seen in the past. Reducing the budget reserve by almost one-quarter will leave the state less equipped to respond to a recession, potentially meaning services like job training, food assistance, or health care might not be there with Minnesotans and their families need them most.

- Taking money from the budget reserve is a temporary solution that policymakers used to fund a structural gap. This year’s February economic forecast showed that Minnesota had a surplus for the upcoming FY 2020-21 biennium, but a deficit in FY 2022-23. Policymakers used the budget reserve to fill the gap between the amount of projected revenues and the cost of services. Instead, they should have responsibly raised the revenues needed to sustainably fund services that Minnesotans depend on.

It’s imperative to build a strong budget reserve when the state’s economic outlook is good, and Minnesota has made laudable progress. But that budget reserve will only work if we keep it strong and only use it when it’s needed. Policymakers made a mistake this session in drawing down the budget reserve that could likely result in harmful consequences for everyday Minnesotans in the future.