The latest state economic update contains several pieces of good news. Recent state revenues are stronger than anticipated and Minnesota closed out its 2024 fiscal year with revenues higher than previous projections. The recently released October Revenue and Economic Update from Minnesota Management and Budget points to an improved near-term projected outlook for the national economy as well.

Some of the top takeaways include:

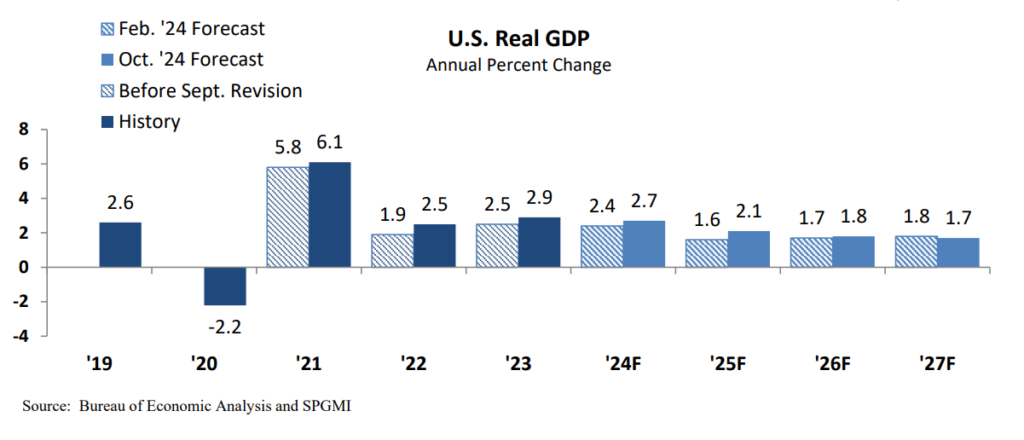

- National economic growth projections for 2024 and 2025 are stronger than in the February Forecast. Forecasters predict national GDP growth in 2024 to be 2.7 percent, 2.1 percent in 2025, and 1.8 and 1.7 percent for 2026 and 2027 respectively. This increase primarily reflects improved financial conditions due to expected changes in federal interest rate cuts, increased employee compensation, and higher than expected productivity rates. While higher near-term growth is anticipated, there is little change from the February forecast for 2026 and 2027. The Update notes that its economic growth projections for 2025 are slightly more optimistic than the Blue Chip Consensus, another highly regarded economic projection. Inflation, as measured by the Consumer Price Index, is projected to be 2.8 percent in 2024 and 2.0 percent in 2025, showing little change from what was anticipated in February.

- State revenues for FY 2025 are projected to be higher than in the February forecast. General fund revenues for the first quarter of the current fiscal year, FY 2025, are now estimated to be $234 million, or 3.2 percent, higher than forecasted in February. These higher figures for July to September 2024 result from higher than expected revenue collected from the individual income tax and other revenue sources, which more than balance out lower collections from the sales tax and corporate tax.

- State revenues for the 2024 fiscal year are higher than expected in the February forecast. The state’s 2024 fiscal year ended on June 30, 2024. General fund revenue for FY 2024 is now estimated to be $30.3 billion, which is $494 million, or 1.7 percent, higher than forecasted in February. This positive balance from the close of the fiscal year is $73 million stronger than what was preliminary reported in the July economic update; the major source of this increase was higher than expected revenues collected between the end of July and the official close of books.

- As of September, the U.S. labor market is holding relatively steady. The Update provides labor market data that can shed some light on how workers are contributing to the economy and what opportunities are available to everyday folks. In September, the labor force participation rate, which is the share of working age adults who are working or looking for work, was about the same as a year ago, and the national unemployment rate was 4.1 percent, which is slightly less than the month before and up by 0.3 percentage points from the unemployment rate in September 2023. The state’s economic forecasters have predicted that the national unemployment rate will stay at 4.2 percent through the beginning of 2025 and gradually rise to 4.6 percent by 2027.

What to expect next with the Minnesota budget?

We’ve lost count of how many blogs on state quarterly updates or forecasts in a row in which we’ve said some version of “revenues to date are coming in stronger than anticipated, and we need to keep an eye on the future.”

Revenues coming in higher than expected is good news. It means the state is on track to fund the near-term commitments they made to Minnesotans with the tax and budget decisions they made in the 2023 and 2024 Legislative Sessions, which included things like increased funding for schools, investing in affordable child care, and making college more affordable.

And we also know that while one-time surplus dollars generated in the past continue to play an important role in funding public services and contributing to projected surpluses, some additional revenues will be needed to sustainably fund crucial public services once those surplus dollars are expended and to address unmet needs into the future.

In the 2025 Legislative Session, policymakers will set the state’s next two-year budget, covering the 2026 and 2027 fiscal years. At the end of the 2024 Legislative Session, the state was projected to have a $1.7 billion positive general fund balance at the end of FY 2026-27. That surplus number could change when we get a more comprehensive update on the state’s budget landscape at the beginning of December when Minnesota Management and Budget will release the November Budget and Economic Forecast (yes, it is called the November forecast but it comes out in December).