Note: this blog has been updated since its initial publish date on December 1, 2025.

On December 4, 2025, we’ll all get an important look at how the state of Minnesota is being affected by federal policy actions and their economic impact.

That’s when the state agency called Minnesota Management and Budget (MMB) will release the November 2025 Budget and Economic Forecast.

What is the November Forecast?

The November forecast is an annual report on the state’s budget and economic outlook. It is a tool for policymakers and the public to understand the state’s current and future landscape. This forecast and the updated one that will be released in February provide critical but incomplete information that will inform the governor and legislators as they act to respond to sweeping federal changes and their impact on the state’s budget, economy, and people.

The November 2025 forecast will project revenues and spending in the state’s general fund based on existing law, including the state budget passed earlier in 2025 and recent federal legislation. The forecast also accounts for how expected economic conditions influence state revenues and services.

This November forecast is especially important because it will provide a picture of some of the estimated impacts on the state budget and economy from federal actions, especially the federal Reconciliation Bill H.R. 1 (also called OBBBA or the Megabill), which made the biggest cuts in their history to Medicaid and SNAP (food assistance), and transfers substantial responsibilities to the states while at the same time cutting federal funding states receive.

The forecast’s required focus on the state budget means it won’t reflect all of the new costs of H.R. 1 and other federal actions that will be passed to individuals, hospitals, counties, and others who rely on federal funding for basic needs services like SNAP, Medicaid, and other programs. The forecast document won’t describe the full scope of hardship caused by the recent federal government shutdown, during which thousands of Minnesota federal workers were out of work or working without pay and there were devastating stops and half-starts to SNAP food assistance, which reaches 440,000 Minnesotans. By the end of the year, federal failure to extend enhanced premium tax credits will make health insurance much less affordable for nearly 20,000 Minnesotans who would lose all financial assistance to purchase ACA marketplace basic health plans. These and other cost shifts from the federal government to people, health care providers, counties, and others will mostly not appear in this forecast.

State faces substantial budget challenges ahead

The November forecast will provide updated budget projections compared to what they were at the end of the 2025 special legislative session.

When policymakers passed the state’s FY 2026-27 two-year budget in June, they did so in a challenging environment. The 2025 February Budget and Economic Forecast projected a small short-term surplus for FY 2026-27, and, further out in FY 2028-29, a $6 billion deficit. Throughout the 2025 Legislative Session, policymakers debated whether to protect and build on the potentially transformational investments they made in the 2023 budget or to roll some of them back. Some policymakers proposed raising revenues to protect Minnesotans’ access to crucial public services in the face of likely federal cuts, while others proposed shrinking the deficit by cutting services.

| General Fund balances | ||

| February 2025 Forecast | End of Session 2025 | |

| FY 2026-27 | +$456 million | +$1.9 billion |

| FY 2028-29 | -$6.0 billion | -$1.1 billion |

In the budget agreement they reached, policymakers cut total spending compared to the baseline budget, leaving a larger positive balance in the current biennium and shrinking the projected deficit in the FY 2028-29 biennium.

However, these end-of-session budget balances did not include the potential impact of federal actions on the state’s budget, or what it would require for the state to maintain Minnesotans’ access to health care, food assistance, and other services in the face of the historically harmful cuts to services proposed in H.R. 1. For example, it’s estimated that 140,000 Minnesotans could lose their health care coverage because of the federal law.

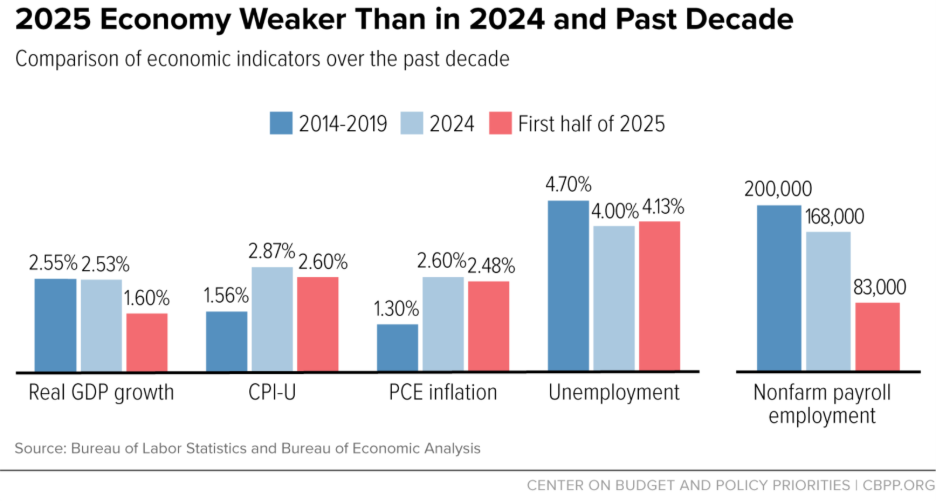

A weakening economy will also likely pose challenges for the state’s budget. The strong U.S. economy from the beginning of the year has deteriorated. Nationally, we are not in a recession, but both the labor market and the wider economy are showing signs of softening. MMB’s October Revenue and Economic Update reports that the national GDP forecast for 2025 was revised down by the state’s economic forecaster, SPGMI. And other economic forecasters are even more pessimistic about the country’s future.

Besides GDP, other economic indicators are also showing softening. U.S. payroll employment has slowed, in significant part because of Trump Administration immigration policy. Forecasts for business investment and consumer spending, when they’re adjusted for inflation, are also expected to weaken compared to the beginning of the year. Overall, today’s “split economy” is one in which higher-income Americans continue to do well while affordability challenges are top of mind for most everyday American workers and consumers.

A softening economy can show up in the forecast as lower state revenues. One potential warning sign is that recent state revenues have come in less than projected. State revenues for July to September were $90 million – or 1.2 percent — less than projected in February of this year.

A bright spot of news that creates a one-time improvement in the state’s budget balances came this fall when MMB “closed the books” for FY 2024-25. In this final accounting for that biennium, revenues outpaced spending by even more than previously estimated. As a result, an additional $941 million in one-time resources carries forward and will show up in the November Budget Forecast as an increase in the starting balance for FY 2026-27.

If the November forecast shows a surplus for the current biennium, up to $161 million of that would automatically flow into the state’s budget reserve, further strengthening the state’s rainy day fund.

Expect uncertainty to be a theme among forecast interpreters

This forecast carries greater levels of uncertainty than in more normal times. Challenges facing MMB include accurately estimating the impact of federal legislation. Because of delayed or confusing guidance from federal administrators, many of the details directing implementation of the harshest policy changes of H.R. 1 are yet to be determined.

Lack of data may also be a problem. During the federal shutdown, the federal Bureau of Labor Statistics was not able to collect employment data. This means that SPGMI and other forecasters — as well as the Federal Open Market Committee, which sets interest rates and is tasked with lowering inflation and keeping employment up – lost a key data point in understanding the country’s economic health.

Looking ahead: what Minnesota policymakers should do

Since the state’s two-year budget is in place, Minnesota state policymakers are not required to pass a budget next year. But this is not a normal time, and this November forecast will help inform the key tax and budget decisions that policymakers will wrestle with in 2026 and beyond.

Policymakers must take bold action to prioritize and protect Minnesotans’ health and economic well-being at a time that so many are facing hardship and disruption, rather than accept the damage that federal actions would inflict.

This should be the guiding principle as policymakers respond to the massive new obligations and loss of federal funding. Because of H.R. 1, the state and counties must implement counterproductive and onerous policies like Medicaid work reporting requirements and cover more of the costs to administer and pay for SNAP benefits. Policymakers will need to determine how to protect health care access in every part of the state in the face of unsustainable Medicaid funding cuts facing rural and safety net hospitals and nursing homes.

We’re calling on Minnesota policymakers to raise revenues, especially from those with the most resources, in order to replace lost federal funding and protect crucial services that meet Minnesotans needs during this unprecedented time in our nation’s history. Minnesota should not erode our state revenues further by conforming to H.R. 1’s skewed tax priorities; instead, policymakers should disconnect our state from ineffective tax breaks for high-income households that H.R. 1 has made even more costly, and not adopt the bill’s temporary, poorly designed carveouts that do little to respond to the economic struggles of everyday Minnesotans.

What’s next

After the forecast is released, we’ll provide more analysis on its topline numbers, including projected general fund surpluses or deficits in the current and future budget cycles, the economic projections underlying the forecast, and any other standout items.

Note: In the November Forecast, MMB took a more limited approach to incorporating the likely impacts of federal law changes than we assumed in our original blog post. This blog has been edited to more accurately reflect MMB’s approach. See our upcoming blog for more details about which federal impacts are reflected in the forecast’s budget figures.