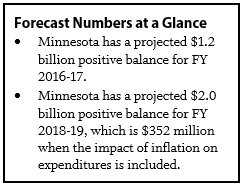

The November 2015 Economic Forecast brought some good news. The state of Minnesota continues to be in positive budget territory, with a $1.2 billion positive balance for the current two-year budget cycle, FY 2016-17.[1] Minnesota also has a projected positive balance for the upcoming budget cycle, FY 2018-19, of $2.0 billion. While the state’s economy is improving and performing better than the U.S. economy, many Minnesotans have been left behind in the recovery.

In the 2016 Legislative Session, policymakers will make choices about how to use this positive balance. According to this latest forecast, the state’s future economic success depends on broader participation in the workforce. Given that, policymakers have the opportunity to make smart investments so that more Minnesotans can get and keep quality jobs and access ladders into the middle class. Lawmakers should focus tax policies on continuing to make our tax system more equitable among income levels. They should resist calls for large and unsustainable tax cuts which would prevent the state from investing in quality schools, affordable higher education and training, and other building blocks of a stronger economy.

Minnesota Forecast to Have Positive Balances

The forecast shows that Minnesota’s economy is still improving. As of this fall, unemployment in Minnesota was 3.7 percent, much lower than the national rate of 5.0 percent. Nationally, this recent unemployment improvement has included those hit hardest by the recession. Even though disparities remain, unemployment has fallen for workers across race, gender, age and educational levels.

However, labor force growth has been sluggish at both the state and national levels, and the forecast’s economic projections are dependent on labor force growth. The rate of people working part time for economic reasons is also high, which means that some workers are not able to find the full-time jobs or hours they need. It is clear that too many workers are not fully participating in the state’s economic recovery.

Minnesota’s economic growth has contributed to a stronger financial situation for the state. The forecast projects a $1.2 billion positive balance in the current budget cycle, FY 2016-17. That’s after $594 million has been transferred to the budget reserve and $71 million is used to repay certain environmental funds.

A policy change passed in 2014 directs the state to transfer up to one-third of a positive balance in a November Forecast to the state’s budget reserve. After the automatic transfer, the state’s budget reserve is now $1.6 billion. Minnesota Management and Budget currently recommends a budget reserve of $2.0 billion for the state to be well prepared for the next economic downturn.[2]

This forecast also gives us a look at the FY 2018-19 biennium, where Minnesota has a projected $2.0 billion structural balance. Taking the impact of inflation on expenditures into account decreases the positive balance to $352 million. In other words, if funding for current services were increased to keep up with the cost of inflation, only $352 million of the surplus would remain.

The state’s economic forecasts are a critical tool that policymakers and the public use to measure the state’s fiscal health and form the baseline against which to assess spending and tax proposals. Minnesota Management and Budget prepares forecasts each November and February. State, national and global economic trends are used to estimate Minnesota’s future revenues and expenditures under current laws on taxes and spending.

Notably, for more than a decade now, the official forecast figures have left out the impact of inflation in their projections of future spending. Failing to include the impact of inflation can lead policymakers to make tax and budget decisions that are not sustainable. The state’s Council of Economic Advisors has recommended that Minnesota include inflation in its planning estimates so that they provide a more useful guide to policymaking.

Positive Balance due to Higher Revenues this Biennium, Lower Spending

The positive balance in the November forecast can be attributed to a few factors. For FY 2016-17, revenues are coming in higher than expected, primarily due to higher sales and corporate tax collections that offset slightly lower than expected income tax collections.

The positive balance is also due to lower spending. The largest cause of this is in Health and Human Services, mostly due to a drop in Medical Assistance spending as a result of lower costs for health care and savings from the state’s competitive bidding process. This lower spending more than offsets some higher expenses in E-12 Education, due partially to student enrollment growth.

The forecast gave us additional good news for the state’s Health Care Access Fund, which funds key portions of Minnesota’s health care system. The fund has a positive balance extending to FY 2019, due in part to lower costs for health care and competitive bidding savings, as well as higher than expected federal funding for MinnesotaCare.

Economic Growth Expected, but Dependent on Labor Force Growth

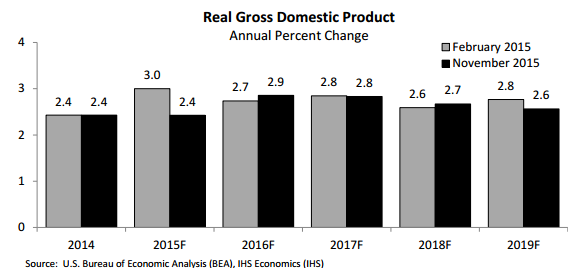

The national economy grew more slowly in FY 2015 than was anticipated in the February Forecast, with annual growth rates between 2.6 percent and 2.9 percent now expected through FY 2019. It’s good news that the economy is still growing, but the forecast notes that continued economic growth in the U.S. and state economies depends on strong labor force growth. The clear implication for policymakers is that policy choices that ensure more people can reach their potential in the workforce are imperative for the state and national economies’ future growth.

Like any prediction of the future, this economic forecast is subject to risk. Forecasters assign a 65 percent probability that their baseline economic forecast will be accurate. Forecasters assign a 20 percent chance to a more pessimistic scenario where global markets are not stabilized, resulting in weaker economic growth. They also assign a 15 percent probability to a more optimistic scenario in which better-than-expected household formation and productivity strengthen the U.S. economy.

Policymakers Should Prioritize Strengthening our Workforce

The data in the November Forecast show that Minnesota’s future economic success depends on building a strong and skilled workforce. Tax and budget choices made in the next legislative session should prioritize strategies that expand economic opportunity for working Minnesotans across the state, allowing them to get and keep the jobs they need to support themselves and their families. Three critical steps to ensure Minnesotans succeed include:

- Making affordable child care available to more Minnesota families. This allows parents to work and employers to get the employees they need, while children can thrive in stable environments. Currently, more than 6,000 families are on waiting lists to receive child care assistance. Increasing funding for Basic Sliding Fee Child Care Assistance and expanding the Child and Dependent Care Tax Credit to more lower-income families are two important ways to address some of the child care challenges Minnesota parents face.

- Improving the Working Family Credit to support work and make our tax system fairer. Improving the state’s Working Family Credit supports people working at lower wages so they can better make ends meet. Such tax credits are shown to greatly benefit children, keeping them healthier and offering a stronger start in life and learning. The Working Family Credit also is a key component to making our tax system fairer. It’s still the case that lower-income Minnesotans on average pay more in local and state taxes as a share of their income than higher income Minnesotans. Increasing the Working Family Credit can narrow that gap.

- Expanding access to work supports like earned sick and safe time. Currently, 1.1 million Minnesotans lose wages or even their jobs when they need to stay home to care for themselves or a family member. By expanding access to sick time, policymakers can support the state’s workers and promote good jobs in the workforce.

The forecast clearly points to strengthening the state’s workforce as a priority to continued economic success. Large tax cuts are not the response. Looking at other states provides evidence that tax cuts don’t work as an economic development strategy. For example, Kansas had been most aggressive in its tax cuts and yet its economy shrank in 2013, the first year the tax cuts went into effect. And Kansas continues to lag behind; this year its economy is only expected to grow by 1.2 percent, just half the projected rate of economic growth nationally.[3]

The November forecast brought our state some good news, but policymakers should be careful not to threaten our future growth. They should invest in the state’s workforce to ensure that Minnesota workers reach their full potential, while ensuring that tax decisions don’t put our state’s future at risk.

By Clark Biegler

[1] Data in this analysis come from Minnesota Management and Budget, November 2015 Budget and Economic Forecast, December 2015.

[2] Minnesota Management and Budget, 2015 Budget Reserve Report, September 2015.

[3] Center on Budget and Policy Priorities, Kansas’ Economic Growth Continues to Lag, Despite Tax Cuts, November 2015.