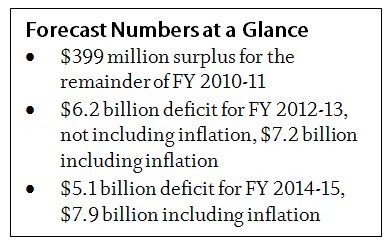

Minnesota once again faces a significant budget deficit. The state’s latest economic forecast projects a deficit of $6.2 billion for the upcoming FY 2012-13 biennium, or 16 percent of the general fund budget.[1] Adding the cost of inflation increases the size of the deficit, requiring another $1 billion to maintain services at their current level in the next biennium.

The November forecast gives Minnesotans their first look at the state’s FY 2014-15 biennium, which begins July 1, 2013. Based on current law, the FY 2014-15 deficit is projected to be $5.1 billion. The deficit grows to $7.9 billion if the impact of inflation is included.

In the short term, the picture looks a bit better. The state is expected to finish the current biennium, which ends on June 30, 2011, with a $399 million surplus. More than half of the surplus, $231 million, comes from federal aid approved in August. Lower-than-expected spending on health care and debt service also contribute to the surplus, more than offsetting a small revenue decline and special session spending on disaster relief. This surplus means that policymakers will not need to make adjustments to the current biennium’s budget.

The prolonged economic slowdown has played an important role in creating significant revenue shortfalls in most states, including Minnesota. However, heavy reliance on short-term solutions to solve Minnesota’s revenue shortfalls has led to larger deficits that we otherwise might face.

The Purpose of the Forecast

Minnesota’s constitution requires the state to have a balanced biennial budget, and the forecast is a critical tool to meet that goal. The forecast is the official measure of the state’s fiscal health. It serves as the yardstick against which the Governor and legislature will assess their budget and tax proposals for FY 2012-13. Economic forecasts are prepared each February and November by Minnesota Management and Budget. The forecast estimates future revenues and expenditures based on current laws and economic assumptions. It does not include the impact of any budget changes policymakers are considering this legislative session.

Reliance on One-Time Measures Contributes to Size of FY 2012-13 Deficit

For years, Minnesota has faced political gridlock between those who favor a balanced approach to solving budget shortfalls – raising revenues and cutting programs – and those who want to solve the deficit with a cuts-only approach. Compromises have focused on one-time solutions, which have balanced the budget in the short term but not had a long-term impact.

While policymakers closed a similarly-sized FY 2010-11 deficit in the 2010 Legislative Session, one-time measures were a large part of their solution, which had little effect on the FY 2012-13 deficit.

- In FY 2010-11, the state received $2.3 billion in federal economic recovery dollars that temporarily replaced state funding for education and health care services, allowing the state to maintain these investments and avoid job losses during the recession. These federal dollars do not continue next biennium, so the state would need to restore $2.3 billion in general fund spending to maintain the current levels of services.

- The state shifted $1.9 billion in K-12 education payments from the FY 2010-11 biennium into FY 2012-13. That shift created a one-time savings in FY 2010-11, but $1.4 billion of that delayed school payment is scheduled to be repaid in FY 2012-13. This $1.4 billion in “new spending” does not represent an increase in school funding, but repays a loan from last biennium.

- There are $660 million in one-time unallotments – including both cuts in services and delays in paying tax refunds – initially made by Governor Pawlenty and then ratified by the legislature that only have an impact in FY 2010-11.

The fact that these measures do not have an ongoing impact contributes to the size of the deficit in FY 2012-13. They also contribute to an artificially large 27.5 percent increase in general fund spending from FY 2010-11 to FY 2012-13. As noted above, much of this increase is not from new spending, but instead from timing shifts and from state dollars replacing federal dollars in education and health care. After taking into account these one-time cost savings, the increase in spending in FY 2012-13 is approximately $2 billion, or 6.6 percent — much closer to the projected five percent growth in revenues.

The $2 billion in increased spending called for under current law is focused in three areas. Growth in the elderly and special needs population and increasing health care costs will push cost increases in health and human services, which are expected to grow by about $1 billion in the next biennium. K-12 education spending will grow $500 million due to enrollment growth, increases in the number of students qualifying for free- or reduced-price lunches, and special education costs. And debt service costs will grow by $300 million, due to increased bonding and rising interest rates.

Slow Economic Growth Expected

The state’s ongoing revenue shortfalls are connected to continued expected slow economic growth. According to the forecast, U.S. unemployment rates will exceed eight percent until 2014. While Minnesota’s economy was not hit as hard as the rest of the nation, it still lost 157,000 jobs during the recession, hitting the bottom in September 2009. Since then, the state has added 55,000 jobs. The leisure and hospitality sector have rebounded the fastest while some sectors continue to decline, including construction work and local government.

Global Insight gives a 65 percent probability that the economy will follow the slow economic recovery predicted in the forecast. Since the forecast was released, Global Insight has slightly upgraded its outlook, now giving a 20 percent chance that the economy will follow a more optimistic, fast growth path. As a result of the projected economic growth, Global Insight has removed the prospect of a second recession from its economic projection. In November, Global Insight said there was a 20 percent chance of a double-dip recession. Now it projects that there is a 15 percent chance of one negative quarter in 2011.[2]

Forecast Already Includes the Fiscal Impact of Early Action on Health Care

As required by law, the November forecast assumed that Minnesota’s next governor would act to take advantage of a provision in the federal Affordable Care Act that allows Minnesota to provide extremely low-income adults without dependent children with health coverage through Medicaid. Governor Dayton signed an executive order implementing this option on January 5, 2011, covering individuals with incomes up to 75 percent of the federal poverty guidelines, or $677 a month. This provides a better solution for coverage for these individuals than the existing General Assistance Medical Care.

The federal government will pay 50 percent of the costs for covering these very low-income individuals, bringing the state more than $1 billion in federal resources in the FY 2012-13 biennium. In 2014, when the Affordable Care Act is fully implemented, that federal share will rise to 100 percent of the costs.

In addition, thousands of individuals currently enrolled in MinnesotaCare, which provides affordable, premium-based health insurance for working families, will now be eligible for Medicaid, reducing the financial pressures on the Health Care Access Fund and preserving MinnesotaCare for working families. If Governor Dayton had not opted to cover these individuals through Medicaid, it would have reduced the state’s general fund deficit by $384 million. However, it would have increased the deficit in the Health Care Access Fund to $615 million. When the fund runs a deficit, the Minnesota Department of Human Services must bring the fund into balance through actions such as limiting eligibility, removing people from the program and increasing premium costs.

What Next? A Prescription for Budget Bifocals

State leaders face difficult decisions. The state is in a painfully slow economic recovery and residents face immediate needs for jobs, health care and basic services. Minnesota also needs to best position itself for long-term growth by making critical investments in education and infrastructure. State leaders need to put on their budget bifocals, looking both at near-term needs while not losing focus on long-term prosperity.

An important way to meet both our short-term and long-term goals is to include revenues as part of the solution. In the short term, investments in education, health care and job training will help those hit hardest by the recession by maintaining adequate funding for critical services while preserving jobs during the economic recovery. In the long term, these investments in healthy citizens, vibrant communities and an educated workforce will position Minnesota for future prosperity.

Lawmakers have already played most of the easy cards in past legislative sessions, now what are left are the hard decisions.

[1] Unless otherwise noted, the information in this analysis comes from Minnesota Management and Budget’s November 2010 Economic Forecast.

[2] Minnesota Management and Budget, January 2011 Economic Update: State Revenues Tracking Forecast.