State policymakers had a critical task this legislative session: setting a state budget for the next two years that meets Minnesotans’ health, safety, and economic security needs, and builds a more equitable recovery. They had to do so in the context of the continued disruption from a pandemic and economic recession. Hundreds of thousands of Minnesotans were struggling, and particularly lower-income and Black and Brown Minnesotans who have been disproportionately harmed by COVID-19. Facing significant disruptions to education, work, and more, as well as the renewed attention to disparities and disinvestment that predated the pandemic, Minnesotans called for transformative and bold solutions to help them get back on their feet and to build a more equitable future for our state.

The budget-setting process had to adapt to a rapidly changing economic landscape. The state faced projected deficits when the 2021 Legislative Session began. But soon it became clear that the pandemic’s economic impact was remarkably uneven.[1]

Many of those with the most resources actually were seeing their incomes and wealth grow. While some businesses struggled, others thrived. As a result, the damage to state tax revenues was less than what was first expected. By February, state forecasters projected a $1.6 billion budget positive balance for the FY 2022-23 budget cycle.[2] In addition, federal policymakers passed additional financial resources for state and local governments.

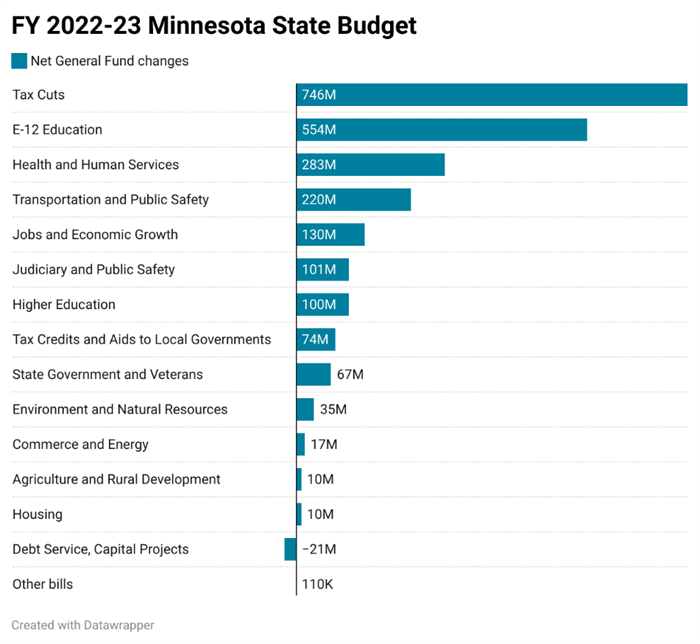

Minnesota policymakers worked right up until the last minute to reach agreement on all the pieces of budget legislation, narrowly avoiding a state government shutdown. In the final budget agreement, Governor Tim Walz and the Legislature used the $1.6 billion state general fund surplus and $633 million in flexible federal American Rescue Plan Act (ARPA) dollars in putting together a new state budget for the FY 2022-23 budget cycle. E-12 education and tax cuts got the largest pieces of these additional resources.

While some budget components will have a meaningful impact on Minnesotans’ lives, it falls short of making transformational change and truly meeting the critical moment we’re in. This brief takes a look at some of the largest items in the state budget, some of the specific provisions that have an impact on the state’s progress toward fully responding to this critical moment and implications for our future.

E-12 Education

The largest new investment went toward E-12 education, which received $554 million in net additional funding for FY 2022-23. The overwhelming majority of this funding goes to increase funding for school districts through the basic student formula, which is the largest source of state funding to school districts. Funding through the formula is increased by 2.45 percent in FY 2022 and 2 percent in FY 2023. That’s an increase of $161 per student in the first year and another $135 per student in the second year to keep up with the cost of inflation and better support students.

The education budget also includes a handful of proposals to better ensure Minnesota’s schools provide a quality education and supports for all students, whether Black, Brown, or white. A number of these proposals would support expanding the number of teachers of color in Minnesota. Addressing the deep divides in opportunity through our education system is critical, but policymakers still have a long way to go. Several proposals supported by the governor and House were not included in the final education budget, such as additional support for advanced coursework for BIPOC (Black, Indigenous, People of Color) students and ensuring that all students learn about Minnesota’s full cultural heritage through Indigenous Education for All.

Fortunately, the final budget does not include a harmful discriminatory policy proposal that would have excluded trans students from participating in public school sports programs that are in alignment with their gender identity.

Health and Human Services

The final budget allocated $283 million in additional net general fund dollars to Health and Human Services, the part of the state budget that covers a broad range of health care services, services for our elders and people living with disabilities, economic supports, and more.

The budget included a long-awaited economic support for some of the Minnesotans most harmed by the COVID-19 pandemic. It includes a one-time $435 economic support payment for the very low-income families participating in the Minnesota Family Investment Program (MFIP). These Minnesotans have been disproportionately likely to suffer job loss in the pandemic, because they often work in the hotel, retail, and restaurant sectors – sectors that have been especially hard hit by the pandemic. But they have had less access to pandemic-related economic supports. The final agreement represents a compromise; the House’s and governor’s budgets originally included a one-time payment of $750. The budget also includes an annual cost of living adjustment to the baseline MFIP grant amount so that these families can better keep up with the cost of basic expenses such as diapers and rent.

The budget also increases provider reimbursement rates in the Child Care Assistance Program, funded in the near term with federal ARP dollars. Increasing provider rates helps ensure families can choose a child care provider that meets their needs. While this is an important step forward, reimbursement rates will still fall below the expenses many families face. The budget raises reimbursement rates to the 40th percentile of 2021 market rates for infants and toddlers, and to the 30th percentile for preschool children and older.[3]

Budget elements that promote Minnesotans’ health include:

- Extending health care coverage through Medicaid for new parents for 12 months after they have given birth (previously limited to only two months post-partum)

- Reducing premiums for MinnesotaCare to match federal requirements, which will make health care more affordable for many Minnesotans; and

- Improvements to mental health supports including culturally responsive mental health services and a one-time increase in school-linked mental health grants.

However, policymakers failed to enact a House provision that would have laid the groundwork to expand access to affordable health insurance coverage to Minnesotans currently left out, including workers without affordable insurance through their employers, undocumented Minnesotans, and others who fall through the cracks.

Policymakers also missed an opportunity to expand access to SNAP food assistance for Minnesotans with incomes up to 200 percent of the federal poverty line, which the federal government would have paid for almost entirely. As we continue to navigate the COVID-19 pandemic, over 180,000 adults in Minnesota report that their household doesn’t have enough to eat.[4] This is truly a missed opportunity to put federal dollars to work to care for our communities.

The Health and Human Services budget bill includes $26 million in FY 2022-23 to support Minnesotans experiencing homelessness, including for emergency shelters and long-term supports. In addition, the final Housing budget includes $10 million, particularly for workforce housing. Housing has long been unaffordable for too many Minnesotans, and the COVID-19 pandemic has only exacerbated this problem. One in 10 Minnesota renters report being behind on their rent.[5] In addition, the state will receive about $388 million in federal ARP funding for emergency rental assistance, homeowners assistance, and for services for people experiencing homelessness.

Higher Education

While critical to obtaining greater economic opportunities, higher education has been severely disrupted by COVID-19, which has strained the ability of students, especially low-wealth and BIPOC students, to afford it and remain enrolled. To aid the recovery from COVID-19, policymakers adopted a higher education budget that makes investments in Minnesota’s students and institutions. It increases the state’s net general fund investments in higher education in FY 2022-23 by $100 million by providing additional direct financial aid to students and increased operations support to the state’s public higher education systems.[6] Although these investments are important, further action is needed so all students can equitably access higher education.

The higher education budget increases direct financial aid to students in the State Grant program, which is the primary way the state helps students afford the costs of attending public or private higher ed institutions. The budget keeps in place a recent increase to the size of state grants. Early in the pandemic, the Office of Higher Education increased grant awards by increasing the amount of living expenses considered in determining aid amounts by $386. The budget largely formalizes this increase in statute. However, the budget did not include a House proposal to increase financial aid grants further.

The higher education budget also provides increased operational support to public colleges and universities. The Minnesota State Colleges and Universities (MNSCU) system, the state’s largest public higher education system, receives an additional $56 million over the biennium. Operations and maintenance support make up most of this increase. Additionally, the budget also includes an additional $39 million for the University of Minnesota system, again primarily for operations and maintenance support. Both of these appropriations fall below the MNSCU and University of Minnesota budget requests.

Racial justice and community safety

The police killings of several Black men in the Twin Cities including George Floyd, Daunte Wright, and Winston Smith, have highlighted the ways our justice systems are failing. The budget legislation made some important, incremental policy changes, but ultimately missed the opportunity to boldly meet the moment we’re in.

The final public safety budget includes a few provisions to help keep Minnesotans, and particularly Black and Brown Minnesotans, safer in their interactions with police. These provisions include:

- Limits on no-knock search warrants;

- A requirement for 911 operators to refer calls regarding mental health crises to a trained mental health crisis team where available; and

- The creation of an “early warning system” to better identify patterns of misconduct among police officers.

There is still much more progress to be made for all Minnesotans to feel safe, and to ensure that an arm of state and local governments does not harm community members. The killing of BIPOC Minnesotans is an urgent crisis that policymakers at all levels of government should continue to treat accordingly.

The House state government budget included a specific proposal to pave the way for ensuring racial equity becomes an integral part of the Legislature’s policymaking process. Similar to the way bills receive a fiscal note so that policymakers and the public can understand their fiscal impact, this proposal would have created a working group to develop a process for racial equity impact notes to articulate the racial justice implications of proposed legislation. Policymakers, advocates, and community members’ efforts to reflect the priorities of all Minnesotans, regardless of who they are or where live, will be improved by better understanding the equity impacts of policy and budget proposals. This policy was not enacted this year.

Economic security

The budget includes an important provision to prevent small mistakes from snowballing into a devastating cycle. Fines and fees from traffic tickets and minor criminal violations can add up to over $100, which creates a particular hardship for low-income families. Prior to the recently passed budget, Minnesota could revoke someone’s driver’s license for failure to pay a ticket in a timely manner. The result could mean the inability to drive to get the work – or risk further tickets and hardship by driving without a license.

Fortunately, the FY 2022-23 budget would stop suspending driver’s licenses for things like an unpaid fine for a traffic violation, or failure to appear in court on a petty misdemeanor traffic violation. It also institutes a single fee to reinstate a driver’s license, rather than multiple “stacking” fees. Further, the budget gives judges discretion to waive or reduce the $75 state surcharge currently imposed on every traffic and criminal violation, or offer a community service alternative, in cases of financial hardship.

The budget also includes a positive step forward toward a more inclusive economy by repealing a decades’ old prohibition that kept high school students from accessing unemployment benefits. This rights an injustice seen during COVID when these younger workers and their families faced the financial hardship of job loss but couldn’t access the same economic supports as other workers. That happened even though their employers contributed to unemployment insurance for their jobs. Access to unemployment insurance will continue to be crucial as many Minnesotans still struggle to find work and make ends meet during the prolonged impact of the COVID-induced recession.

The final budget also creates a working group to decide how to distribute $250 million to essential workers who have been working on the frontlines of the pandemic.

Unfortunately, some important provisions to build a more equitable economy were not enacted this year.

- Both the governor and House proposed increasing the number of Minnesota workers and families with access to earned sick and safe leave and paid family and medical leave. These are critical elements of a more equitable economy, and ensuring that illness doesn’t lead to financial hardship. Neither policy was passed during the legislative session, despite everything we’ve learned during the pandemic about the importance of paid leave.

- Allowing all Minnesotans to access driver’s licenses regardless of their immigration status would have acknowledged the contributions of immigrants working, learning, and living in our communities, and who so often continued to work on the frontlines during the pandemic to keep our economy running. This provision was passed by the House.

Infrastructure

The transportation budget includes funding for state road construction and maintenance as well as some investments in Twin Cities transit. The House’s budget would have raised new revenues for future investments in Twin Cities and Greater Minnesota transit systems, but these provisions were not included in the final budget.

Policymakers also included $24 million for a targeted capital project grant program for nonprofits and governmental entities that serve communities that have historically been left out of the state’s bonding process, including BIPOC-led organizations and BIPOC communities. Bonding dollars allow local governments and organizations to make long-term investments in their communities by funding infrastructure and economic development projects.

Tax policy and aids to local governments

The pandemic caused increased demands on government services. As a record number of people lost jobs, hundreds of thousands of Minnesotans were unable to afford the basic expenses of their daily lives. Some businesses and nonprofit organizations sought help to stay afloat as their revenue sources shrunk. Schools and other public services faced unexpected demands for new technology and protective equipment.

The pandemic also exposed the real costs of failing to invest in a robust system of supports, the unnecessary hardship when folks already struggling to make ends meet don’t have paid sick leave or family leave when their hours are cut, or access to broadband or technology to work and learn from home.

Facing these and many other examples of the consequences of both previous lack of investment and new demands related to COVID, both Governor Tim Walz and the Minnesota House of Representatives put forward proposals to raise additional revenues, calling on those with the most resources to contribute a bit more to get through the pandemic and fund a stronger, more equitable future. These included a new “5th tier” millionaire’s income tax bracket on Minnesotans with the highest incomes, and raising taxes on corporations, including those earning profits overseas. As the state’s revenue forecast improved and federal assistance was passed, these policymakers recognized that federal dollars were temporary, and new state revenues were still needed to sustainably fund public services and make structural changes to tackle economic, racial, and geographic disparities.

Walz and the Minnesota House also put on the table proposals to make the tax system more equitable and inclusive, especially for lower-income and BIPOC Minnesotans, through strong expansions of the state’s Working Family Credit and property tax refunds for renters (Renters’ Credit).

The Minnesota Senate, in contrast, opposed efforts to raise more revenues. While Walz and the House’s tax plans contained a combination of revenue-raising and tax cutting proposals, the Senate focused on tax cutting.

Ultimately, policymakers agreed to a tax bill that cut taxes by $746 million in FY 2022-23 and $150 million in FY 2024-25, and increases funding for tax credits and aids to local governments by $15 million in FY 2022-23 and $53 million in FY 2024-25.[7]

To put that in context, that means nearly half of the state’s FY 2022-23 general fund surplus was allocated to tax cuts, with the two largest items relating to businesses that received federal Paycheck Protection Program (PPP) loans and jobless workers who received Unemployment Insurance.

Normally, Unemployment Insurance benefits are taxed like many other forms of income. As the COVID pandemic created an unprecedented rise in job loss, the federal government took bold actions to expand Unemployment Insurance, such as including some workers normally left out and providing an additional weekly “pandemic” UI benefit. These additional benefits got out the door quickly to jobless workers so they could support themselves and their families, but income taxes were not withheld. The federal government later acted to exempt up to $10,200 of UI benefits from income taxes (equaling the maximum amount of pandemic UI a worker could have received). This exemption applies only to workers with adjusted gross incomes below $150,000. The state omnibus tax bill makes the same exemption for state income taxes.

The single largest item in the tax bill was a $409 million tax reduction for businesses that received PPP loans. The bill also made a permanent cut to the statewide property tax paid by businesses (also known as the state general levy), and provided other tax reductions for certain industries. In all, tax cuts for businesses and investors made up 65 percent of the total tax cuts in FY 2022-23 and 73 percent of the tax cuts in FY 2024-25.

Permanent tax reductions focused on working class people were smaller. One highlight is that the state’s Working Family Tax Credit will now reach more lower-income workers. While low-income workers without dependent children have long been eligible for the credit, they have also needed to meet age requirements. This year’s tax bill lowers the age requirement for these workers to include those 19 or 20 years old. An estimated 26,200 workers will become eligible, and receive an average $165 tax credit.[8]

Unfortunately, the tax bill does not include proposed broad-based increases to state property tax refunds, also known as the Circuit Breaker (for homeowners) and Renters’ Credit. The tax bill allows those with veterans disability compensation to exempt that income for purposes of calculating their property tax refunds, which will result in about 34,000 Minnesota households receiving larger tax refunds.

The budget also boosts funding for Taxpayer Assistance Grants, which fund nonprofit organizations that provide free assistance in tax preparation and filing. These services ensure low-income workers and families get the full value of the tax credits for which they qualify.

The tax bill also creates Local Homeless Prevention Aid, a new stream of funding to counties to address homelessness among children. It can be used to fund family homelessness prevention and assistance projects, and will provide $20 million per year in funding; unfortunately, this funding does not start until FY 2024 and ends in FY 2029.

The bill also creates a new Tax Expenditure Review Commission so that policymakers and the public can take a closer look at who benefits from what’s already in the tax code. Tax expenditures are “provisions which reduce the amount of revenue that otherwise would be generated, including exemptions, deductions, credits, and preferential tax rates.[9] This commission is required to initially review state tax expenditures to identify their purpose statements and metrics for evaluating each expenditure. It will then review and evaluate tax expenditures on a regular, rotating basis, and hold public hearings on the expenditures it reviews. It will submit a report to the Legislature each year, which will also receive a public hearing in the legislative tax committees.

Priorities for future surplus dollars

The budget includes two provisions that will go into effect if the state projects a surplus in a future budget forecast, which could be as soon as the November forecast to be released late this year.

- While this year’s budget agreement withdraws $100 million from the state’s budget reserve, future surplus dollars will be transferred to the state’s budget reserve until its balance reaches $2.4 billion. It’s currently at $1.8 billion.

- If a November forecast has a positive balance, funds will be used to reduce the amount of June accelerated sales tax payments that some retailers and vendors are required to remit until they are fully eliminated.[10]

Meeting the needs of Minnesotans and building a more equitable recovery

Facing a pandemic and an economic crisis that continues to impact Minnesotans across the state, policymakers had a critical task this session: to support and care for those struggling the most and start to build a more equitable recovery. The governor and Legislature made some important investments in the FY 2022-23 budget, but it ultimately fell short of what’s fully needed in this moment and for the long term. Many areas of the budget see important boosts in FY 2022-23 but a significantly smaller amount of new investment in the next biennium. These include many of the areas that contribute to Minnesotans’ health and well-being, including health and human services, transportation, jobs and economic growth, environment and natural resources, and commerce and energy. (See appendix 1.)

Hardship and inequality didn’t originate with the pandemic. Minnesota has long been home to deep divides in opportunity across lines of race, income, and geography; past and current policy and budget choices contribute to those disparities. Our pre-pandemic state budget was not doing enough to make Minnesota a state where everyone can thrive. This new budget doesn’t do enough to reverse the deep inequities baked into our current systems that disproportionately harm BIPOC and lower-income Minnesotans.

We’ve not yet become the state of shared prosperity that we can become. Labor market participation in still down, and as of June 2021, 1 in 10 Minnesota adults said they couldn’t afford to give their children enough to eat, 93,000 Minnesotans were behind on rent, and nearly 800,000 were having trouble covering basic household expenses.

Policymakers must focus on the goals of addressing the needs in our communities and for a more equitable recovery as they make additional budget decisions in the weeks, months, and years ahead, including about how to use federal funds coming from the American Rescue Plan.

The budget agreement laid out the process for using flexible ARP funding coming to the state. Walz will determine how to allocate $500 million, the state budget legislation passed in June allocated $1.2 billion over the next four years, and decisions about the remaining $1.2 billion will be made in the 2022 Legislative Session. In addition, the ARP allocated billions of dollars to dedicated purposes (such as education, higher education, housing, and child care), and to local and tribal governments in Minnesota. These funds too should be used to contribute to a more equitable and prosperous Minnesota. Raising additional state revenues could maintain those investments after the temporary federal dollars are gone.

Minnesota has the resources needed to make bold and equitable investments in our state. It is imperative that policymakers don’t miss another opportunity to do so.

By Clark Goldenrod, Abimael Chavez-Hernandez, and Nan Madden

[1] Minnesota Budget Project, Covid-induced recession is most unequal on record, February 2021.

[2] Except where otherwise noted, the analysis in this report is based on data from budget documents prepared by Minnesota Management and Budget and the applicable state agencies, and legislative research and fiscal departments. The opinions expressed are those of the Minnesota Budget Project.

[3] The rates will update to using the 2024 rate survey in January 2025.

[4] Center on Budget and Policy Priorities, Tracking the COVID-19 Recession’s Effects on Food, Housing, and Employment Hardships, August 2021.

[5] Center on Budget and Policy Priorities, Tracking the COVID-19 Recession’s Effects on Food, Housing, and Employment Hardships.

[6] Minnesota House Fiscal Analysis Department/Senate Counsel, Research, and Fiscal Analysis, Senate and House Joint Spreadsheet Conference Agreement, June 2021.

[7] In addition, a “leadership agreement” of an additional eight items was included in the omnibus tax bill, since it would be the last piece of legislation passed in the special session. This included an additional $60 million of items, including $29 million in additional aid to counties impacted by a property tax assessment issue, and $1.5 million in FY 25 (and more in the future) in economic development incentives for a oriented strand board plan. These items are not included in the figures above referring to the omnibus tax bill.

[8] Minnesota Department of Revenue, Analysis of Special Session Laws 2021, Chapter 14, July 2021.

[9] See Minnesota Department of Revenue’s Tax Expenditure Budget reports.

[10] “June accelerated sales tax” is a provision of law that requires some retailers and vendors to submit some of their sales taxes for June earlier than usual for other months. It has the effect of those revenues falling into an earlier state fiscal year than if they followed the normal schedule.