Uncertainty, Conflict Fill Last Days of 2010 Session

Minnesota policymakers faced challenges during the 2010 Legislative Session, including a $1 billion state budget deficit for the FY 2010-11 biennium, a court decision that created last-minute budget uncertainty and the realization that large budget deficits loomed in the state’s future.

Unfortunately, policymakers did not seize opportunities to set the state on a sound financial track and avoid damaging cuts to services that help struggling Minnesotans recover from the recession. In the face of strong opposition from Governor Pawlenty, legislators were unable to enact a balanced approach of both spending cuts and new revenue to solve the state’s deficit. The Governor also opposed legislative efforts to take advantage of a chance to access federal dollars to provide health care to some of the state’s most vulnerable citizens. Instead, policymakers left a very difficult situation for the next legislature and new governor to tackle next year.

Policymakers Faced Several Tough Issues

The challenges facing policymakers began to take shape early in the legislative session. At the beginning of March, the state’s economic forecast said the state faced a $994 million deficit for the FY 2010-11 biennium, slightly down from the $1.2 billion deficit that had been projected in late 2009. The February forecast also revealed that the state was facing a $5.8 billion deficit in the FY 2012-13 biennium, or about 15 percent of projected spending for the biennium. Adding the impact of inflation increased the size of the deficit to nearly $7 billion.

Adding to the tensions, in early May the Minnesota Supreme Court overturned one of the Governor’s unallotment actions from 2009. That opened the door for more legal challenges to most of the $2.7 billion in unallotment decisions. With only weeks left in the session, uncertainty ran high over how the court case would affect the size of the state’s budget deficit. Deciding to look at the worst case scenario, many lawmakers assumed the unallotments would be overturned and the state now faced a $2.9 billion deficit for FY 2010-11.

In addition, state leaders wrestled all session with how to provide health care coverage for extremely low-income adults without dependent children. A compromise agreement early in the legislative session continued a revised form of General Assistance Medical Care (GAMC) for these vulnerable adults. However, as flaws in the new program were emerging, federal health care reform suddenly presented the state with a more appealing option for covering these individuals.

Decisions on the federal level impacted the 2010 Legislative Session in other ways. For months, policymakers waited to see if Congress would pass additional state fiscal relief, notably through an extension of increased federal funding for Medicaid. As part of the 2009 American Recovery and Reinvestment Act (ARRA), Congress temporarily increased the federal share of Medicaid costs to help ensure that states would not reduce access to health care during the recession. But this increased rate is set to expire at the end of 2010, even though states continue to face significant budget deficits. An extension of this funding would bring Minnesota an additional $408 million in resources for health care.

Revenue increases were also an important part of the debate during the 2010 Legislative Session. The legislature sought a balanced solution to the budget that would have begun to reduce the state’s future deficit. In the session’s final days, the legislature passed a combination of revenue increases, spending shifts and spending reductions. New revenues would have accounted for about 15 percent of the budget balancing solution. The Governor, however, continued to maintain his objections to any tax increases.

Over the course of the legislative session, the Governor, House and Senate found it difficult to come to a consensus on how to resolve these issues. Ultimately, the state’s budget was balanced, although the solution came in three separate stages. The stages included $312 million in spending reductions in most areas of the budget, a $147 million reduction in health care services, and $2.9 billion in ratified unallotments and other spending reductions.

Stage 1: Early Action Reduces Deficit by $312 million

Policymakers took action early in the session to begin to address the state’s budget deficit. In late March, the Governor and legislature reached an agreement to reduce the deficit by $312 million. The agreed-upon solution included spending cuts and significant transfers from special revenue accounts in nearly every area of the state budget. Reductions to the two largest budget areas – K-12 education and health and human services – were set aside to be decided later in the session.

This first round of budget reductions cut aids to local governments by $105 million in FY 2011 and $210 million in FY 2012-13, solving 11 percent of the FY 2010-11 budget deficit. These cuts come on top of the $200 million in unallotments to aids to local government. Altogether, these reductions represent about a 31 percent cut in total county and city aids. The dramatic decline in funding will inevitably impact the quality of local government services.

The House, Senate and Governor also agreed to a total of $47 million in reductions to higher education, solving five percent of the state’s budget shortfall in FY 2010-11. This comes on top of $100 million in unallotments to the University of Minnesota and Minnesota State Colleges and Universities (MnSCU). Altogether, these cuts reduce state spending for higher education to 2006 funding levels. The cuts significantly impact the affordability of higher education. As a result of changes in state financial aid, approximately 9,400 students will completely lose their financial aid grant and the remaining students will likely see a 19 percent drop in the size of their grant.

The bill also includes budget reductions and one-time transfers from special revenue accounts impacting other areas of the budget, including public safety, affordable housing, workforce development, public transportation and natural resources. The agreement reduced the state’s deficit by $312 million in FY 2010-11, but still left a $682 million budget hole.

Stage 2: Reductions in Health Care for Low-Income Adults Saves the State $147 million

Another significant issue playing out during the early stages of the legislative session was the movement to save health care for vulnerable adults without children. General Assistance Medical Care (GAMC) was initially established in 1975 to provide health care coverage for very low-income adults without dependent children. A state-funded program, it filled in the gap for adults, aged 21 to 64, who were not being served by the health care market. To qualify for GAMC, an individual must have income below 75 percent of the federal poverty guideline, less than $677 a month. These individuals face significant health challenges, including one or more chronic medical conditions, mental health problems, chemical dependency and/or homelessness.

Near the end of the 2009 Legislative Session, Governor Pawlenty line-item vetoed funds for GAMC, effectively eliminating the program in FY 2011. The Governor followed up by making further cuts to GAMC through the unallotment process.

After months of negotiations, discussions with key stakeholders, and two rejected proposals, the Governor and legislature finally reached a compromise in late March that maintained eligibility for very low-income adults, preserved some important features of the original GAMC program and ensured access to affordable prescription drugs.[1]

The GAMC compromise, however, also had many shortcomings. The revised program was dramatically underfunded, offered an unclear set of benefits for recipients and expected participating hospitals to take on a high level of financial risk. Rural hospitals, in particular, were doubtful of their capacity to participate in the revised GAMC program.

By significantly reducing state spending on health care for these individuals, the GAMC agreement cut the state’s deficit by $147 million in FY 2010-11.

As time went on, the flaws in the GAMC compromise became more apparent. The passage of federal health care reform provided Minnesota with the option of covering these low-income adults through Medicaid (known as Medical Assistance in Minnesota), a health care option funded jointly by the federal government and the state.

In mid-May, the legislature passed a provision taking advantage of this opportunity. The action would have drawn down $1.4 billion in federal dollars, provided recipients with a clear set of benefits and offered health care providers higher reimbursement rates and significantly lower financial risk. The state would have paid its share of the cost by using a surcharge on certain health care providers to draw down federal dollars. The Governor vetoed the bill, objecting to the funding mechanism.

Legislature Passes a Balanced Proposal for Solving Deficit

As the final days of the legislative session approached, the state’s budget problem had grown to $2.9 billion: $535 million needed to fix the state’s remaining budget deficit and another $2.4 billion to preemptively deal with the uncertainties resulting from the State Supreme Court decision on unallotment. The House and Senate agreed to a plan to solve the deficit, although their proposal was ultimately rejected by the Governor.

The legislature’s plan to solve the state’s budget deficit was a balanced proposal that included ratifying most of the Governor’s unallotments and raising $434 million in new revenues in FY 2010-11.

Some of the significant unallotments the legislative plan adopted included a $1.8 billion shift in payments to school districts, nearly $300 million in cuts to aids to cities and counties, $100 million in cuts to higher education, a $52 million cut to the Renters’ Credit for low-income households and $152 million in cuts to health and human services.

Legislators also took action to reverse the trend of rising regressivity in Minnesota’s tax system, which has shifted more of the responsibility for funding state and local services on to low- and middle-income Minnesotans. The bill created a new fourth tier income tax rate, increasing the rate on taxable income over $200,000 for a married couple from 7.85 percent to 9 percent, an increase that would have blinked off in 2014 if the state’s economy improved. Another provision would have accelerated the expiration of several federal tax cuts that are set to expire next year. The result would have been $434 million in additional revenues in FY 2010-11 and $595 million in FY 2012-13.

The plan for resolving the deficit also included a separate bill with $114 million in cuts to health and human services that would have impacted struggling families, people with mental illness and other Minnesotans with disabilities. These cuts were in addition to the $152 million in approved unallotments to health and human services. As part of this bill, the legislature also included the provision to cover the GAMC population through Medicaid described above.

The legislature did not assume the state would receive $408 million in federal money from Congressional action to extend increased federal funding for health care under Medicaid. By the time the legislature passed their budget-balancing plan, it was clear that Congress would not pass an extension of the federal health care funds prior to the end of the legislative session. But the bill did include contingency language so that if the resources arrived by June 15, 2010, $77 million of the approved unallotments in health and human services would not be implemented and another $36 million would be used to fill a hole in financial aid for higher education.

The legislature passed their plan in mid-May, but it was immediately vetoed by the Governor.

Stage 3: Final Agreement Ratifies Unallotments, Drops Revenue Increases

The Governor and legislature did not come to an agreement on how to solve the state’s budget deficit until the final hours of the legislative session. The Governor called the legislature back for a very brief special session so the compromise agreement could be passed.

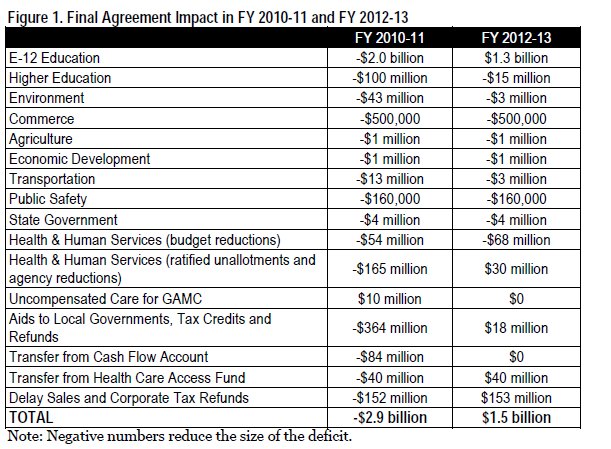

The most significant component of the final agreement is to ratify most of the Governor’s unallotments. The decision to ratify the Governor’s shift in school payments has the largest financial impact. The agreement actually increases size of the shift, saving the state close to $2 billion in the FY 2010-11 biennium. This delay in payments could force some districts into drawing down cash reserves or resorting to short-term borrowing. The bill specifies that the shift will be paid back in the next biennium, but does not include any funding mechanism to pay the price tag. This commitment to repay the shift contributes $1.3 billion to the state’s budget deficit in FY 2012-13.

The final agreement also ratifies most other unallotment reductions, including $294 million in aids to local governments, $100 million to higher education, $52 million from the Renters’ Credit and $160 million to health and human services.

Most of the ratified unallotments apply in FY 2010-11 only and are not made permanent. The bill includes language that restores funding for any unallotments that are not ratified in this legislation, eliminating grounds for further lawsuits.

The final agreement also includes an additional $54 million in cuts to health and human services in FY 2010-11 (on top of the ratified unallotments) that will have some negative impacts on struggling families, people with mental illness and other Minnesotans with disabilities.

For low-income families struggling in this economy, there was some good news: the agreement avoids some of the extremely harmful proposals that had been advanced during the legislative session, such as eliminating General Assistance for low-income adults, cutting assistance for low-income families that live in subsidized housing or that have a disabled family member, reducing funding for child care providers and deeply cutting resources for a job creation initiative that provides short-term skill-building work opportunities.

However, there are cuts that will impact these families. The agreement reduces a cash bonus for individuals who successfully leave welfare for work (this bonus helps the state meet federal performance requirements). The agreement also makes a one-time cut of unspent child care funds that could have been used to serve qualified families who are waiting for help, although there are no permanent reductions. In addition, the agreement redirects $28 million in federal welfare-to-work funds that came to Minnesota under the federal Recovery Act and are intended to prevent cuts to services for very poor children during the recession.

Minnesotans with disabilities struggling to live independently are significantly impacted by the outcome of the legislative session. The agreement limits access to services that allow individuals to live in their homes and avoid costly institutional care, reduces the hours of in-home assistance to help individuals meet basic needs, and increases fees for parents needing services for their severely disabled children.

There is also a significant cut to the Children and Community Services Act (CCSA), which provides resources to counties to fund social services for children, adolescents and other individuals. One of the most significant uses of these funds is child protection services. The agreement includes a nearly $17 million reduction to CCSA in FY 2010-11 (and a smaller ongoing reduction in FY 2012-13), which is a larger cut than was proposed by either the House or Senate.

The agreement includes a variety of funding cuts to managed care, hospitals and other health care providers. Some of these cuts do not take effect until the FY 2012-13 biennium. There are also smaller cuts to nursing homes and in-home supportive services for low-income elderly Minnesotans. Facing their own budget challenges, these providers may make the difficult decision to cut back on staff, reduce their level of services to all clients, or even stop providing some services altogether.

The final agreement does not take advantage of the opportunity to cover low-income adults without children through Medicaid, but does allow Governor Pawlenty or the next governor to opt-in by January 2011.

The final agreement makes some modifications to GAMC, including adding $10 million to the uncompensated care pool and allowing hospitals to cap the number of individuals they will serve in the program. It is hoped that reducing the financial risk will encourage more hospitals to participate in the program, especially in Greater Minnesota.

Minnesota policymakers made no assumptions about whether Congress would extend the enhanced Medicaid matching rate, potentially bringing $408 million to our state. If Congress does pass the bill, the funds will drop to “the bottom line,” helping with the state’s cash flow situation and preventing additional cuts to critical services if a new deficit opens up later in the year.

At the last minute, several large provisions were added to help bring the agreement into balance.

- It expands the Department of Revenue’s existing authority to delay corporate income and sales tax refunds, saving the state $152 million in the current biennium. These refunds will be paid in the FY 2012-13 biennium.

- It transfers $84 million from the cash flow account to the general fund. These funds are not repaid in the FY 2012-13 biennium.

- It transfers $40 million from the Health Care Access Fund. These funds will be repaid in the FY 2012-13 biennium.

The Future Budget Deficit

The final agreement relied heavily on one-time cuts to services and timing shifts. As a result, the final agreement made no headway in reducing the state’s future budget problems – the deficit figure remains at $5.8 billion for the FY 2012-13 biennium, or $6.9 billion if the impact of inflation is factored in. This figure includes the legislature’s commitment to pay back the K-12 education shift in the next biennium.

The outcome of the 2010 Legislative Session was that policymakers failed to take advantage of opportunities to set the state on a sound financial track, including passing revenue increases that would have helped reduce the state’s deficit in the next biennium. Policymakers also had the chance to avoid damaging cuts to Minnesotans struggling to recover from the recession. For example, passing up on the option to cover low-income adults through Medicaid means fewer people will be able to access the health care they need and the state will lose out on drawing down federal funding.

In the end, the outcome of this session has set up a profoundly difficult situation for the next legislature and new governor to tackle next year.

Except where otherwise noted, the analysis in this report is based on data from budget documents prepared by Minnesota Management and Budget and the applicable state agency, and legislative research and fiscal departments. The opinions expressed are those of the authors.

[1] For additional information on the efforts to preserve health care for low-income adults during the 2010 Legislative Session, see our issue brief, General Assistance Medical Care: Unique Program Serves a Unique Population.