With an almost $2 billion projected surplus, there was great potential in the 2015 Legislative Session to expand economic opportunity in Minnesota. But as they sought to set the state’s next two-year budget, Governor Mark Dayton, the House and the Senate put forth very different priorities for the state, which ultimately required a special session to resolve. The final tax and budget agreement they reached is a combination of positive steps toward a future of more broadly shared prosperity, but also many missed opportunities and even some steps backward.

Their budget proposals reflected whether policymakers saw this session as an opportunity to invest in the state’s future through targeted funding increases after more than a decade of flat or declining funding in many public services, and to continue to pursue a sustainable tax system that is more equitable among income levels. This approach was taken by the governor and the Senate. In contrast, the House prioritized cutting taxes and reducing the size of state government, especially through dramatic cuts in health care.

More specifically, Dayton’s budget proposal sought to expand early learning opportunities for Minnesota’s children, and to make both child care and college educations affordable for more Minnesota families. He also proposed raising new revenues to increase the state’s investment in a safe and modern transportation system, and put forward a sustainable package of tax cuts focused on the challenges faced by Minnesota families. The Senate echoed many of the governor’s priorities in their budget bills, prioritizing investments in education, health and human services, and transportation. Their tax proposal focused on reversing payment shifts and strengthening funding for local governments, which they saw as a key to keeping property taxes in check.

The House’s budget proposal took a very different approach, and included a tax bill that was larger than the projected surplus and grew unsustainably larger over time. Because their tax bill was so large, the House made smaller funding increases in other parts of the budget than the governor or Senate, and even made substantial cuts in health care, affordable housing and other critical services.

With such different proposals on the table and different parties holding majorities in the two houses of the Legislature, policymakers had trouble coming to agreement. Several of the budget bills passed by the Legislature were vetoed by Dayton. Lawmakers entered a special session in June after reaching a compromise and passed new budget bills for education, economic development and housing, and environment and agriculture.

Despite a great deal of attention to increasing investments in transportation, policymakers were unable to agree on funding sources, and only a relatively status quo transportation bill was passed. Policymakers also were unable to reach agreement on taxes, and no major tax bill was passed this session.[1]

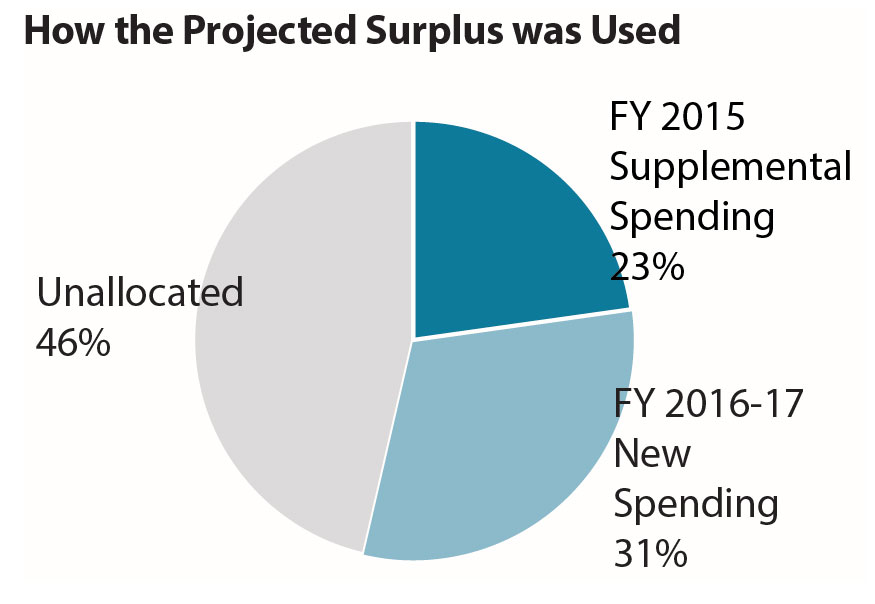

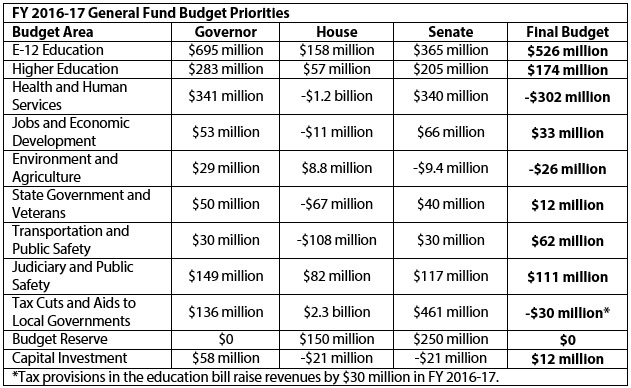

The final budget agreement allocated $573 million, or about one-third of the surplus, to new spending for FY 2016-17, with K-12 education, higher education, and judiciary and public safety receiving the largest amounts of additional funding. Despite the surplus, health and human services, and environment and agriculture saw a net reduction of their funding from the general fund. Policymakers also used $429 million of the surplus for supplemental spending for FY 2015. The remainder of the surplus – $865 million – was unallocated. This amount remains “on the bottom line” and will contribute to the resources available in the 2016 Legislative Session.

No surplus dollars were used this session to boost the state’s budget reserve, even though both bodies of the Legislature had proposed further building up this “rainy day fund” so that it can better meet the needs of Minnesotans during the next economic downturn. Nonetheless, the reserve will likely see an automatic boost later this year, because up to one-third of any surplus for FY 2016-17 measured in the state’s November economic forecast will automatically go into the reserve.

In the final budget agreements, policymakers made some important progress toward shared economic prosperity in Minnesota, like increasing access to affordable child care and keeping down the cost of higher education. However, there were also serious lost opportunities, such as the failure to expand earned sick time to more Minnesota workers, to allow all Minnesotans to have the economic opportunities that come with a driver’s license regardless of their immigration status, or to expand tax credits for working families, such as the Child and Dependent Care Tax Credit and the Working Family Credit. And some Minnesota families will face higher costs for health care because of cuts to MinnesotaCare.

This analysis examines the details of the budget agreed to by Dayton, the House and Senate, focusing on areas of new investments and changes that will impact low-income and vulnerable Minnesotans.[2] The table below summarizes the differences between Dayton’s budget proposal, House and Senate budget bills, and the final budget.

E-12 Education Budget Increases Funding for Schools and Initiatives to Narrow Racial Achievement Gap

A strong education is crucial to a person’s economic success; making sure all of Minnesota’s children get a solid education is key to the state’s future success. Minnesota has long made education a priority, but significant achievement gaps between white students and students of color remain. The governor vetoed the Legislature’s first education budget bill because he thought it did not make a large enough investment in education, and it did not include his initiatives to address the state’s racial achievement gap or for expanded pre-kindergarten. The final education bill included both increased funding for all districts across the state and more targeted funding intended to narrow the achievement gap.

The E-12 education budget increases funding for school districts through the basic student formula by 2.0 percent in both FY 2016 and FY 2017, an increase of $117 and $119 per student each year. In terms of early education, it includes $48 million for early learning scholarships for low-income preschoolers, $31 million for school readiness, and $10 million for Head Start, which should cut the Head Start waiting list of about 2,500 children nearly in half. The education budget does not include the centerpiece of the governor’s early education initiatives, which was to make voluntary pre-kindergarten programs available to all four-year-olds. The final bill also includes several initiatives proposed by the governor and Senate to address the racial achievement gap, such as:

- $4 million for the Northside Achievement Zone and the St. Paul Promise Neighborhood, which focus on reducing multigenerational poverty in North Minneapolis and the Frogtown and Summit-University neighborhoods in St. Paul.

- $3.1 million for the state’s English Learner program to expand funding for students from six years to seven years so that students can become proficient in English.

- $3.5 million for the Minnesota Reading Corps, which helps students achieve reading proficiency standards at an early age so that they are not left behind.

- $17 million in new funding for American Indian education aid.

Policymakers Address Cost of Tuition at State’s Universities and Colleges

Affordable higher education is essential to build the skilled workforce the state needs for its future economic success. It’s also essential if all Minnesotans are to have access to the economic opportunities that higher education and workforce training offer. However, since the recession, state funding for four-year public colleges and universities has fallen dramatically while the average annual tuition has risen by about $1,700.[3]

The final higher education budget includes an additional $122 million in FY 2016-17 to reduce the growth in tuition at the University of Minnesota and Minnesota State Colleges and Universities. This is not enough, however, to fully freeze the cost of tuition at those institutions.

Policymakers also strive to make education more affordable through financial aid. The Minnesota State Grant program has a living allowance, which policymakers increased to match the federal poverty level to help Minnesota students meet their basic needs while in school. The budget also provides $800,000 in additional funding in FY 2016-17 for American Indian scholarships to serve an estimated additional 250 students.

Health and Human Services Budget is a Mixed Bag

The health and human services area of the budget includes a range of services so that Minnesotans can afford care that meets their needs, as well as supports to enable families to reach economic stability. While there are some important new investments in this area of the budget, policymakers also made some harmful choices that will increase barriers to affordable health care for many Minnesotans.

The final health and human services budget makes several investments in Minnesota’s children and families, including increased funding for Basic Sliding Fee Child Care Assistance by $10 million in FY 2016-17. Affordable, dependable child care allows children to thrive, parents to get to work or school, and employers to have the reliable employees they need. The increased funding means that 350 more families will have affordable child care in an average month. But there is still more to do. More than 4,000 families are currently on a waiting list for Basic Sliding Fee, which serves kids from infancy through age 12 and covers the number of hours and range of times parents need to work. Both the governor and Senate included additional funding for Basic Sliding Fee in their budgets.

Another $68 million will go towards supporting the state’s youth. This includes $52 million for child protection reforms, $2 million for the Homeless Youth Act and $3 million for the Safe Harbor for Sexually Exploited Youth. Other important investments in the health and human services omnibus bill include a $138 million increase for nursing homes, $3.3 million more for dental providers, and $76 million for new, improved and expanded services people with mental health and chemical dependency issues. Two changes to Medical Assistance totaling $8.2 million will make it easier for seniors and people with disabilities to fit health insurance into their monthly budgets.

Unfortunately, these funding increases are accompanied by harmful cuts. The most disappointing is the $65 million cut to MinnesotaCare, which will increase the cost of health care through higher premiums and triple out-of-pocket costs. People who get their health insurance through MinnesotaCare typically earn 138 to 200 percent of federal poverty guidelines ($15,654 to $23,540 for an individual), leaving them little room to handle this price hike. Chronically ill MinnesotaCare enrollees will be hit the hardest by the increased out-of-pocket costs. And many may put off a needed doctor’s visit because of the increased costs.

This result is much better than the House’s proposal to replace MinnesotaCare with a much smaller tax credit to buy insurance in the marketplace, which would have left Minnesotans without any affordable health care option. But that will be of little comfort to the more than 100,000 Minnesotans who receive their health insurance through MinnesotaCare. Dayton and the Senate did not cut MinnesotaCare in their final health and human services proposals.

The health and human services bill may also create a new bureaucratic roadblock to health insurance. The Department of Human Services is instructed to use data matching to identify people who receive health care through Medical Assistance or MinnesotaCare and “may not meet eligibility criteria.” The state is then required to request clarifying information. If a person does not respond, they could lose coverage, regardless of whether or not they are actually eligible.

When Illinois hired a third party vendor to do similar work, the state later found that four out of five people who lost their coverage did so simply because they failed to respond to requests for more information. Illinois also reported that almost 90 percent of these Illinoisans were “likely eligible,” but lost coverage anyway.[4] Minnesota should learn from Illinois’ example, and ensure that this new measure does not cause Minnesotans to lose their health care coverage simply for missing or misunderstanding a mailing.

Policymakers also missed an important opportunity to help thousands of Minnesota children take a step away from living in deep poverty. The budget does not include a proposal from the Senate and Dayton that would have raised the cash grant in the Minnesota Family Investment Program (MFIP) for the first time in 29 years. Since 1986, a very low-income family of three participating in MFIP has received $532 per month. That amount does not cover a family’s basic needs. A strong body of research connects increased family resources to better outcomes for kids, including better health and educational outcomes.

Modest Investments in Economic Development, Housing and Judiciary

A strong workforce has been one of the keys to Minnesota’s economic success. And a strong workforce needs education, specialized training and stable housing. The economic development budget includes some additional resources, particularly to support low-income Minnesotans and Minnesotans with mental illness. The Judiciary budget also contains an important provision to help low-income Minnesotans get legal assistance.

The economic development and housing bill includes $2.5 million for Bridges, which provides housing assistance for very low-income Minnesotans with serious mental illnesses. Bridges has a waiting list of about 1,300 households and the additional funding is estimated to help about 200 of them. The bill also includes $2 million to support employment for persons with disabilities or mental illness. These populations experience higher rates of unemployment and poverty than other Minnesotans; the investments seek to help these Minnesotans participate more fully in our economy.

The economic development and housing budget also includes $2 million for the Housing and Job Growth Initiative in FY 2016-17, which builds affordable housing in areas that are seeing high job growth but not enough housing is available for workers.

Importantly, the bill does not include some harmful policy provisions included in the House bill that would have lowered wages and threatened job quality. The House’s proposed tip penalty would have lowered wages for certain tipped workers, and a local interference provision would have prevented local governments from setting higher wage and job quality standards than state law.

Policymakers also included funding to help low-income Minnesotans receive the legal assistance they need. The judiciary budget includes $1.8 million in additional funding for civil legal services that will help more low-income families get legal assistance to resolve housing, credit, family matters and other civil issues.

Unfortunately, policymakers failed to expand earned sick and safe time to the over one million Minnesota workers who currently lose pay, or even their jobs, when they take time off work to care for themselves or a sick child. This must be considered one of the lost opportunities of this legislative session.

Policymakers Agree to Status Quo Transportation Bill

Many had touted 2015 as “The Transportation Session,” and indeed the governor, House and Senate all proposed substantial additional funding for transportation. Dayton and the Senate proposed increasing some existing transportation funding sources, while the House sought to take existing general funding sources and dedicate them to transportation. Ultimately, policymakers were unable to bridge their differences on transportation funding, and instead passed a relatively status quo transportation bill.

The governor proposed raising an additional $2.3 billion in FY 2016-17 in revenues dedicated to transportation and transit, including gas taxes and the Metropolitan Area Transit sales tax. These additional revenues would have been used for transportation improvements such as increased bus service in Greater Minnesota as well as expanding bus operations substantially and improving transit shelters in the Twin Cities. The Senate included very similar proposals in their transportation bill.

The House transportation proposal was funded in part by taking existing funding sources that currently go to the general fund and dedicating them instead to transportation. This would have meant more funding for transportation, but fewer resources available for schools, public safety and other areas of the budget.

A lost opportunity in this area is the failure to pass a Senate proposal to expand access to driver’s licenses for Minnesotans regardless of immigration status. Having a driver’s license can open a door to greater economic opportunity, which also has a positive ripple effect on the state’s economy. It also ensures the state’s roads are safer by requiring everyone to take a driving test before they get behind the wheel.

Clash of Priorities Resulted in Tax Stalemate

Much was at stake this session on tax policy: would policymakers continue the state’s recent progress towards a tax system that is equitable and raises the revenue needed to sustainably fund the state’s priorities? Or would the state go in reverse?

The tax proposals put forward this session by the House, Senate and the governor varied considerably in their size and priorities. Dayton’s tax cut proposals focused primarily on expanded tax credits for low- and middle-income families. The Senate’s tax bill prioritized sustainability and boosting funding for local governments. The House’s much larger $2.3 billion tax bill exceeded the size of the projected surplus and grew larger over time because it included several provisions that took many years to be fully in effect.[5]

In session negotiations, the ability to reach agreement on a tax bill was linked to finding agreement on new transportation funding. As noted above, policymakers were unable to reach agreement, and the 2015 Legislative Session ended with no major tax bill being passed.

The most positive outcome of the lack of a tax bill is that the state avoided passing unsustainable tax cuts, such as eliminating the statewide property tax, or cutting taxes primarily paid by high-income households, such as the estate tax. Such policies would have reversed the state’s progress toward a more sustainable and equitable tax system. The downside of not passing a tax bill is that policymakers also did not enact any proposals that would have made the tax system better meet the needs of Minnesota working families, such as expanding the Child and Dependent Care Credit and the Working Family Credit.

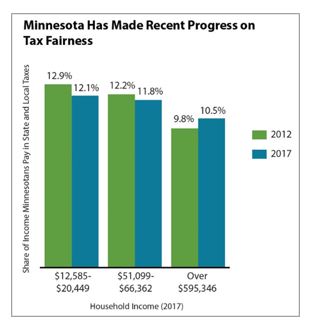

This year was an opportunity to make Minnesota’s taxes more equitable across income levels. It’s still the case that the highest-income Minnesotans pay a smaller share of their incomes in total state and local taxes, although the gap between them and other Minnesotans has closed considerably thanks to tax legislation passed in the last two years.[6]

At the same time, policymakers needed to be careful not to go too far in terms of tax cuts. Large tax cuts passed in the late 1990s and early 2000s proved to be unsustainable, and were followed by deep cuts in services and a greater reliance on property taxes, double-digit tuition increases at our state colleges and universities, and higher fees – all of which shifted more of the responsibility for funding public services to low- and middle-income Minnesotans.

Two of the leading proposals considered this year to make the tax system more equitable and better for working families were to expand the Child and Dependent Care Credit to more low- and moderate-income families, and increase the Working Family Credit.

Child care can be one of the largest costs that families with children face, and expanding the Dependent Care Credit is an important strategy to make affordable child care available to more Minnesota families. Minnesota’s Child and Dependent Care Tax Credit helps offset a portion of child care costs so parents can work or look for work, but the credit hasn’t kept up with the rising costs of child care.

Dayton made expanding the Dependent Care Credit the centerpiece of his tax proposal. His proposal would have increased the credit by $105 million over the two-year budget cycle through two major changes. First, the maximum income at which a family qualifies for the credit would increase to $112,000 for families with one dependent and to $124,000 with families with two or more dependents. Second, the maximum amount of credit a family could receive would rise to $1,050 for families with one child and $2,100 for families with two or more dependents. The House omnibus tax bill included a similar proposal that was more focused on moderate-income families. The House’s $35 million proposal included the same increase in the maximum credit as in Dayton’s proposal, and would lift the income limit to $56,000 for families with one child and $68,000 for families with two or more children.

The governor also proposed expanding the Working Family Credit, which is a critical tool to ensure that people working at lower wages don’t pay more than their fair share in Minnesota taxes. Dayton’s proposed $83 million expansion of the Working Family Credit would have reached over 310,000 Minnesota families. The Working Family Credit is based on the federal Earned Income Tax Credit (EITC), and builds on the EITC’s proven success in supporting work, reducing poverty and improving the health and educational success of children. Dayton’s proposal would have increased the Working Family Credit for most households who are already eligible, and enabled another 30,000 households to qualify.

Expanding the Working Family Credit and the Dependent Care Credit for more lower-income Minnesota families are two ways policymakers could have made the tax system fairer and better meet the needs of working families. Failure to make progress on these priorities was a significant lost opportunity.

While it is disappointing that progress was not made in 2015, there was a real danger that the state would go in reverse. The short-term and long-term threats caused by too much tax cutting was demonstrated by the House tax bill. The bill was larger than the state’s projected surplus, so its tax cuts were paid for in part through deep cuts in affordable health care and other public services. The high cost of the House tax bill also crowded out needed investments in other parts of their budget. And this tax bill grew larger over time, threatening the state’s future ability to sustainably fund schools, colleges and universities, nursing homes and other critical services.

The House bill grew substantially in future years because it included “phased-in” tax cuts that took five or more years to be fully in effect. While phasing in a tax cut reduces its near-term price tag, it prevents policymakers and the public from having good information about its full cost. It also divorces the tax cut from the inevitable trade-offs that will have to be made to pay for it, whether that comes from reduced funding for schools and other services, or by raising other taxes.

The largest proposed phased-in tax cuts in the House bill were:

- Eliminating the state property tax, which is paid by businesses and cabins, over six years at a two-year cost of roughly $2 billion when fully in effect. While this proposal provides tax cuts to all business and cabin properties, it would give the largest tax cuts to the highest-valued business properties when fully in effect.

- Fully exempting Social Security benefits from the income tax. Low- and moderate-income seniors already don’t pay income taxes on some or all of their Social Security income, so they would see little benefit from this proposal.[7] In fact, 41 percent of the tax cuts from fully exempting Social Security would go to households with adjusted gross incomes over $100,000, who would receive tax cuts averaging about $1,500 a year. Further, the large cost of this proposal – about $1 billion per biennium when fully implemented – puts at risk services that are critical for seniors’ quality of life, from community-based services that help seniors stay in their homes to nursing home care.

These were not the only tax cut proposals that were not well targeted. The House’s proposal to cut the estate tax would have provided large tax cuts to only a small number of high-value estates. It would cut the estate tax by $61 million in FY 2016-17, $123 million in FY 2018-19 and more in future years, as it gradually increased the amount of an estate that is exempt from the tax to more than $5 million. Only about 800 of the largest estates in Minnesota pay the estate tax now, so these cuts would primarily benefit a small number of high-income Minnesotans.

In terms of tax policy, the 2015 session ended with opportunities lost, but also serious threats averted. No doubt there will be a similar debate about Minnesota’s taxes next year.

2015 Session Brought Some Successes, But Many Missed Opportunities

With a projected $1.9 billion surplus for FY 2016-17, policymakers had substantial opportunity to ensure that more Minnesotans can share in our state’s economic success. Policymakers made some progress in boosting education funding and increasing access to affordable child care. They maintained the state’s recent progress toward a fair tax system that sustainably funds critical public services; while they failed to make additional progress, they also avoided taking steps backwards. Nonetheless, there were many missed opportunities to invest in increased economic opportunity, such as failing to expand access to driver’s licenses or improving tax credits for working families.

As policymakers work together next year, key priorities should be continuing the state’s progress toward a sustainable and equitable tax system, opening windows for economic opportunity to more Minnesotans, and ensuring that Minnesotans who hit a rough patch have the support they need.

By Clark Biegler, Ben Horowitz, and Nan Madden

[1] Earlier in the session, policymakers passed a federal conformity bill, which updated the state’s tax code to match some federal changes. This reduced taxes in FY 2015 by $20 million.

[2] Except where otherwise noted, the analysis in this report is based on data from budget documents prepared by Minnesota Management and Budget and the applicable state agencies, and legislative research and fiscal departments. The opinions expressed are those of the Minnesota Budget Project.

[3] Center on Budget and Policy Priorities, Higher Education Cuts Jeopardize Students’ and Minnesota’s Economic Future, March 2015.

[4] Illinois Department of Healthcare and Family Services, Illinois Medicaid Redetermination Project Quarterly Report, February 2015.

[5] The general fund cost to do so is included in the total cost of their tax bill shown in the table. The Senate and Governor Mark Dayton put their transportation funding provisions in their transportation bills, so the fiscal impact of those proposals is not included in the total fiscal impact of their tax bills in the table.

[6] Minnesota Department of Revenue, 2015 Minnesota Tax Incidence Study, March 2015.

[7] For more information see House Research, Taxation of Social Security Benefits, November 2014