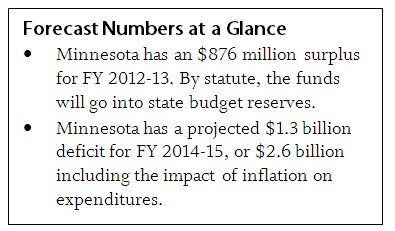

Keeping Minnesota’s economy on the path to recovery is a top priority for everyone in the state. And the State of Minnesota’s 2011 November Economic Forecast offered several pieces of good news. The state’s labor market is showing signs of improvement, with the unemployment rate falling and Minnesotans working more hours. Minnesota’s economy has also been outperforming the national economy, resulting in higher-than-expected state revenue collections. That additional revenue, coupled with lower-than-expected spending, has resulted in an $876 million surplus for the current budget cycle, the FY 2012-13 biennium. These unexpected resources give Minnesota the opportunity to replenish state budget reserves which can act as a cushion against additional budget reductions in these uncertain economic times.[1]

But the nation’s economic recovery is fragile and policymakers have not put the state’s budget on a sustainable path. Although Minnesota has a surplus in the current biennium, the forecast projects a $1.3 billion deficit for the FY 2014-15 budget cycle. Taking into account the impact of inflation on expenditures would increase the size of the deficit, requiring another $1.3 billion to maintain services at their current level in the next budget cycle.

As policymakers consider how to sustainably fund education, health care and other vital services, their decisions will impact the state’s economic growth and the vitality of our communities. Minnesota’s past investments in the state’s economy are paying off today, since the state’s competitive advantage is due in part to a highly educated workforce that keeps and attracts businesses. Policymakers must continue to invest in the basic building blocks of a strong economy: a highly skilled workforce and safe and vibrant communities.

The Forecast is the Official Measure of the State’s Fiscal Health

Minnesota’s constitution requires the state to have a balanced budget. The forecast is a critical tool to meet that goal. The forecast is the official measure of the state’s fiscal health. It is the yardstick against which the Governor and Legislature assess spending and tax proposals. The state prepares forecasts each November and February. They consider state, national and global economic trends, and use them to estimate Minnesota’s future revenues and expenditures based on current laws.

Improved Revenue Collections and Lower Spending Create a Short-Term Surplus

The national economy is in worse shape now than economists had projected last February. Since the national economy influences Minnesota, many policy experts were anticipating the November Forecast would project new revenue shortfalls for the state. Surprisingly, the forecast showed the state’s current budget had an $876 million surplus. On the revenue side, Minnesota ended the last budget cycle with more money than expected, primarily from increased income tax collections. On the spending side, expenses were lower than expected in the last budget cycle, and are also projected to be lower in the current budget cycle, primarily due to lower state health care costs. The slow national recovery has had an impact, and Minnesota’s revenue collections are now falling below estimates. But the combination of all the revenue and spending changes still leaves the state with a surplus.

If a surplus appears in a biennium, state law has clear rules for how the funds must be used. First, the surplus must refill the state’s cash flow account, which is used to manage day-to-day expenses. Second, the surplus must restore the state’s budget reserve, often referred to as the “rainy day” fund. Lastly, a surplus must repay the school funding shifts passed in recent years – delays in state payments to school districts.

In the case of the current surplus, the first $255 million will refill the cash flow account and the remaining $621 million will bring the budget reserve close to its target of $653 million. There will not be any resources left to start repaying the $2.8 billion in various school funding shifts, although any future surpluses would be used for this purpose.[2]

Despite the short-term good news, the forecast still projects a $1.3 billion shortfall for FY 2014-15, which grows to $2.6 billion if the impact of inflation on the cost to provide services is included. This figure does not include the $2.8 billion cost to repay the school funding shifts. Policymakers have not yet found a sustainable way to respond to the unprecedented drop in revenues that resulted from the Great Recession and slow economic recovery.

A Second Recession is Still a Possibility

The national economy is on a slow road to recovery and there remains a significant risk that the nation could stumble back into recession. The forecast – which predicts slow 1.6 percent growth in GDP for next year – assumes that federal policymakers will extend the expiring payroll tax reduction and emergency unemployment benefits into 2012. These two policies help provide income to millions of Americans, allowing them to buy goods and services and spur the economy. If Congress fails to extend these provisions, economists project that the national economy could stall, leading to virtually no growth and the possibility of a recession. Europe’s financial troubles are another significant risk. They could have far-reaching effects, weakening the U.S. economy. Global Insight, Minnesota’s macroeconomic consultant, puts the risk of a 2012 recession at 40 percent.

Corporations Invest in Capital Improvements More than Job Creation

Many economists have said the nation is in the midst of a “jobless recovery,” where it is taking an unusual amount of time for the nation to return to pre-recession employment levels. Productivity is up and corporations are enjoying record profits, but this is not translating into job creation. Businesses have found that by investing in capital purchases (like technology), they can boost productivity without expanding their workforce. The forecast notes, “the U.S. economy is now producing more than it did prior to the recession, but with 6.5 million fewer workers.” That is not promising news for the nearly 160,000 unemployed workers in Minnesota.

Minnesota Has the Opportunity to Get Our Fiscal House in Order

The unexpected surplus gives the state an opportunity to improve its fiscal condition by replenishing reserve accounts, a buffer to prevent painful cuts in services in the face of future shortfalls. However, a short-term surplus does not indicate that the state is on solid financial footing over the long term. Revenues for the current budget cycle already are coming in slightly below projections, and a looming future deficit indicates that policymakers have not yet found a way to sustainably fund education, health care and other important services. How policymakers choose to address these challenges will have a significant impact on our economic future. Past budget decisions reduced our investments in developing our workforce and building safe and vibrant communities. If policymakers opt to make further reductions, we risk undermining our long-term economic success.

[1] Data in this analysis comes from Minnesota Management and Budget’s November 2011 Economic Forecast.

[2] The $2.8 billion includes $2.2 billion to repay delayed funding to school districts and $563 million to repay the K-12 property tax recognition shift.