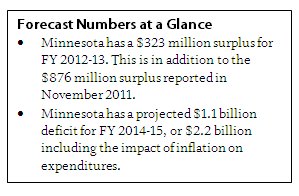

The State of Minnesota’s February 2012 Economic Forecast offers a little more good news – the state has a $323 million surplus for the current budget cycle, the FY 2012-13 biennium. Combined with last November’s $876 million surplus, the state is able to refill the cash flow account, fully restore the state budget reserve and begin repaying delayed state payments to school districts.[1]

While the surplus gives state leaders a chance to catch up on some bills, Minnesota still faces a $1.1 billion deficit in the upcoming FY 2014-15 biennium. Adding the impact of inflation on expenditures would increase the shortfall, requiring another $1.1 billion to maintain services at their current level in the next budget cycle.

The looming shortfall in the FY 2014-15 biennium reminds us of the bigger challenge ahead – the need to develop a sustainable budget that funds the state’s priorities. Minnesota’s future deficit is largely the result of policy choices made during the economic downturn. State leaders have used one-time solutions, such as delaying school aid payments or selling future tobacco settlement payments, as a significant element of addressing recent state budget shortfalls.

The good news is that the national economy continues to improve. However, the recovery is following the slow-growth curve economists had projected last fall. That means the state cannot count on economic growth to generate the significant increases in revenue we would need to bring our budget back into balance.

The Forecast is the Official Measure of the State’s Fiscal Health

Minnesota’s constitution requires the state to have a balanced budget. The forecast is a critical tool to meet that goal. The forecast is the official measure of the state’s fiscal health. It serves as the yardstick against which the governor and Legislature assess any spending and tax proposals. Minnesota Management and Budget prepares forecasts each November and February in consultation with state and national economic advisors. They consider state, national and global economic trends, and use them to estimate Minnesota’s future revenues and expenditures based on current laws.

Surplus Allows State to Refill Reserves, Repay Payments to Schools

When a surplus appears, state law has clear rules for how the funds must be used. First, the surplus must refill the state’s cash flow account, which is used to manage day-to-day expenses. Second, the surplus must restore the state’s budget reserve, often referred to as the “rainy day” fund. Third, a surplus must repay the school funding shifts passed in recent years.

Minnesota’s recent surpluses allow us to restore these accounts and start repaying our debt to our schools. The $876 million surplus measured in November 2011 refilled the cash flow account and nearly refilled the budget reserve. The February surplus means the state is able to fill the budget reserve to $658 million and pay back $313 million of the $2.7 billion needed to reverse school funding shifts. These school aid shifts, enacted during the 2010 and 2011 Legislative Sessions, have stressed local school district budgets, leading some districts to resort to short-term borrowing to meet their cash-flow needs. State law requires that future state budget surpluses will go toward fully reversing the school payment shift, which would require another $2.4 billion based on current estimates.

Most of Surplus Comes from Lower Spending

Minnesota’s latest surplus is mostly attributable to projected spending falling below expectations due to lower enrollment in health care programs and K-12 education. Of the $323 million surplus, $230 million comes from reduced spending. Nearly 80 percent of that is the result of lower-than-expected costs for expanding Medical Assistance (MA) to provide health care coverage for very low-income adults without children. This is a new policy enacted in January 2011, and the state overestimated how many people would enroll. Only $93 million of the surplus comes from better-than-expected revenues (that represents a tiny 0.3 percent improvement over November’s projections).

Tempering Optimism with Caution

The national economy is showing modest improvements from last November’s forecast. Consumer confidence is up and unemployment is down. The state’s economic consultants have lowered the odds that the United States will slip into a double-dip recession from 40 percent to 25 percent, reflecting, in part, easing concerns that the European sovereign debt crisis could pull down the global economy.

However, economic forecasts are based on a number of assumptions and always have some level of uncertainty built in. Forecast estimates this biennium could be off by a greater margin than usual, given the significance of some upcoming policy decisions. For instance, federal deficit reduction could have a major economic impact. Under current law, federal income tax cuts are set to expire next year and automatic spending cuts, known as sequestration, will go into effect. The forecast assumes the President and Congress will reach a “grand bargain,” adopting more modest spending cuts and tax increases. If the grand bargain does not happen, economic growth will be slower than the forecast projects, potentially leading to a shortfall in the current biennium and larger deficits in the future.

Time to Choose a Sustainable Path

The repeated use of short-term fixes to solve Minnesota’s long-term budget imbalance may be placing the state’s financial reputation in jeopardy. Minnesota’s credit rating is already on shaky ground. After last year’s failure to pass a state budget on time, Minnesota’s credit rating was downgraded by two agencies – Fitch and Standard & Poor’s – and Moody’s changed our credit outlook from stable to negative.[2] The lower ratings could lead to higher costs for Minnesota to maintain our infrastructure, such as building and repairing our roads, bridges, schools and libraries; or preserving our historical and environmental spaces. When policymakers reconvene for the 2013 Legislative Session, they will need to take a balanced approach to setting the budget for the FY 2014-15 biennium, with revenues raised fairly, in order to place our state back on the right track.

[1] Data in this analysis comes from Minnesota Management and Budget’s February 2012 Economic Forecast.

[2] Fitch Ratings, Fitch downgrades Minnesota GOs to ‘AA+'</em>; Outlook stable, July 7, 2011, and Standard & Poor’s, Minnesota; General Obligation, September 23, 2011.