Minnesota has a proud history of making affordable health care coverage available to low-income working families. However, Minnesota is at risk of losing one of our greatest legacies – MinnesotaCare. Over the last 20 years, this signature achievement has allowed hundreds of thousands of working Minnesotans to purchase affordable insurance for themselves and their families.

The federal Affordable Care Act, however, creates a new health care landscape and MinnesotaCare in its current form is not compatible with some of the new requirements. Fortunately, the Affordable Care Act gives us the opportunity to continue to provide affordable and comprehensive health insurance for working families by creating the next generation of MinnesotaCare.

Basic Health Plan Option Preserves Access to Affordable and Comprehensive Insurance

When the Affordable Care Act is fully implemented in 2014, many MinnesotaCare participants, along with other lower- to middle-income Minnesotans, will be eligible for federal tax credits to help them purchase private insurance through a health insurance exchange. Unfortunately, many low-income Minnesotans will be unlikely to afford the kind of comprehensive coverage they currently receive through MinnesotaCare, even with the help of federal tax credits.

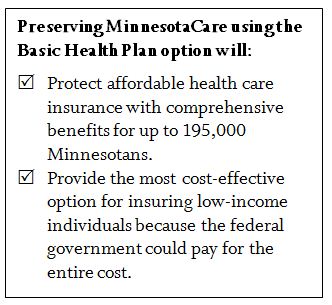

The Affordable Care Act gives us a better option. Minnesota has the ability to preserve the legacy of MinnesotaCare through a financing option in the Affordable Care Act called the Basic Health Plan. Using the Basic Health Plan option to fund the next generation of MinnesotaCare would:

- Preserve affordable coverage with comprehensive benefits for low-income Minnesotans;

- Bring hundreds of millions of federal dollars to Minnesota to pay for health care in our state;

- Ensure more Minnesotans have health insurance coverage that truly meets their needs, reducing levels of uncompensated care for hospitals, doctors and clinics;

- Minimize out-of-pocket costs for health care, protecting Minnesotans from incurring crushing medical debt;

- Eliminate the risk that families would have to repay federal tax subsidies. Minnesotans using federal subsidies to purchase insurance in the exchange may owe the federal government money if their yearly income is higher than expected;

- Improve health outcomes and reduce disparities for low-income Minnesotans.

The Basics of the Basic Health Plan Option

Although the Affordable Care Act gives states significant flexibility in using the Basic Health Plan option, a public health care program funded using this option must meet certain minimum standards:

- Eligibility: Adults with incomes from 138 percent to 200 percent of the federal poverty line must be eligible (for example, a couple with yearly income between $20,879 and $30,260). Lawful immigrants below 200 percent of the poverty line must also be eligible, including those with incomes below 138 percent of the poverty line who are ineligible for Medicaid;

- Benefit Set: The Basic Health Plan option must cover, at a minimum, a state-defined essential health benefit package that includes 10 general categories of benefits;

- Premiums: Insurance coverage must be affordable, and individuals cannot be charged more than what they would have paid in the health insurance exchange.

- Out-of-pocket costs for individuals: Total out-of-pocket costs for Minnesotans must be affordable. Plans offered must have an “actuarial value” between 80 or 90 percent, meaning the insurance plan will pay between 80 to 90 percent of the total covered medical expenses for the average enrollee;

- Plan Options: Minnesota must offer a choice of health plans using a competitive bidding process;

- Financing: Minnesota will receive 95 percent of what the federal government would have paid for tax subsidies and cost-sharing subsidies for these individuals if they had enrolled in the health insurance exchange.

Federal Government May Cover Full Cost of MinnesotaCare Funded by the Basic Health Plan Option

There is the potential that the Basic Health Plan option means Minnesota could continue to provide health care coverage that is as affordable and comprehensive as MinnesotaCare is today and incur no state cost.[1] Official estimates project that Minnesota would receive between $660 million and $916 million in federal dollars through the Basic Health Plan option. Under best-case scenario estimates, federal dollars would be more than enough to finance an improved MinnesotaCare that has lower premiums and better benefits than the program has now, with money left over.[2] Even in other scenarios, Minnesota could spend about what it currently does – approximately $108 million per year to cover 35,000 Minnesotans – and provide affordable and comprehensive insurance for 195,000 people.

Minnesotans Face ‘Bronze Plan Trap’ in the Health Insurance Exchange

If Minnesota is unable to save MinnesotaCare using the Basic Health Plan option, low-income families may need to find coverage through the health insurance exchange, where they will be eligible for tax subsidies. In the exchange they would choose between a bronze plan (with no monthly premiums, but high out-of-pocket costs) and a silver plan (with higher premiums than MinnesotaCare, but lower out-pocket costs). Families at these income levels are extremely price sensitive, with little to no discretionary income left after paying for essentials like food, housing, transportation and child care. Therefore, they are likely to fall into the “bronze plan trap,” where they select the zero-premium bronze plan, but must pay high deductibles and co-payments when they seek health care. Studies show that individuals with high out-of-pocket costs, like the bronze plan, are more likely to avoid seeking medical care, leading to poor health outcomes and more costly medical interventions later on. Using the Basic Health Plan option to fund the next generation of MinnesotaCare eliminates this trap, ensuring Minnesotans can afford both to purchase coverage – and use it.

Basic Health Plan Option is a Chance to Create the Next Generation of MinnesotaCare

With a Basic Health Plan option, Minnesota could invest fewer state dollars per capita while making MinnesotaCare stronger than it is today. On average, Minnesota spends $3,000 per person to insure adults with incomes between 138 and 200 percent of the poverty line.[3] With federal funding from the Basic Health Plan option, we could cut these costs by a third and still have the opportunity to:

- Ensure that coverage options meet the unique health needs of these Minnesotans by improving the benefit set;

- Make health insurance more affordable for individuals and families by lowering monthly premiums;

- Help stabilize families’ health care as they move up the income ladder by coordinating with Medicaid and the health insurance exchange to provide seamless transitions between coverage;

- Increase reimbursement rates for doctors, hospitals and clinics that treat low-income Minnesotans.

Affordable Health Care Coverage is in Jeopardy Without a Basic Health Plan Option

Although the Affordable Care Act offers tax credits to help many lower-income Minnesotans purchase private coverage through the health insurance exchange, for many, that financial assistance won’t be enough to purchase adequate insurance coverage. Leaving adults with incomes between 138 and 200 percent of the poverty line to purchase insurance through the health insurance exchange would be a step backward from MinnesotaCare. The Basic Health Plan option guarantees affordable and adequate coverage, protects families from unreasonable out-of-pockets costs, creates an opportunity to invest in real improvements to MinnesotaCare that would be funded mostly, if not entirely, with federal dollars. That makes it the best option for Minnesota.

By Christina Wessel

Stacie Weeks, formerly employed by Legal Services Advocacy Project, was a co-author on the original release of this issue brief.

[1] Minnesota is projected to spend $305 million on MinnesotaCare for FY 2013, $108 million of which will be spent on the population eligible for the Basic Health Plan (roughly 35,000 people).

[2] Estimates commissioned by the Minnesota Department of Commerce and provided by Jonathan Gruber and Bela Gorman, April 2012.

[3] The state is projected to spend $108 million in FY 2013 on the 35,000 MinnesotaCare enrollees who would be eligible for the Basic Health Plan. The highest estimate for the state cost to create a Basic Health Plan with better benefits and lower premiums than MinnesotaCare is $386 million to cover 195,000 individuals.