The U.S. House and Senate have passed budget resolutions that outline plans for deep cuts to services that families rely on for health care, food assistance, and other basic needs. Currently, they are in the next steps of the budget reconciliation process of naming the details of their budget plans. The House has passed the specifics of their budget reconciliation bill, but the Senate has not yet detailed their version. The painful cuts in all of these budget plans would in part fund expensive, unfair tax cuts that give the biggest benefits to those with high incomes.

If enacted, these budget plans would increase hunger and decrease access to health care for tens of millions of Americans.

Everyday people will lose out during a time when money is already tight and prices are rising even more from tariffs, while the best off among us will get even more.

This blog includes graphs and analysis that reflect the harm these budget plans have on everyday people, primarily to fund tax cuts for people with the highest incomes. It also exposes that these tax cuts won’t create shared prosperity and will worsen racial inequities. Additionally, tariffs will intensify the negative impacts of these plans for working people. The blog concludes with our vision for building a better federal budget.

Budget resolution combines painful cuts to basic services with tax cuts for people with the highest incomes

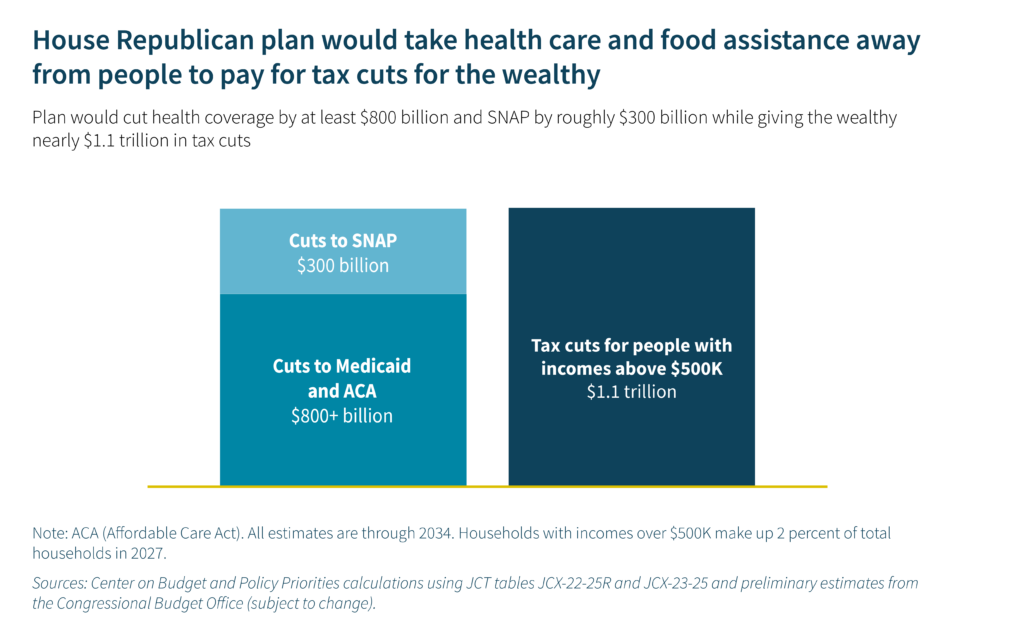

Republican Congressional leaders are speeding down a path that would put Americans’ health and financial well-being in harm’s way as they aim for passage of the detailed budget reconciliation bill on the floor of the Senate before the end of June. Some of the largest areas of cuts would target Medicaid and SNAP (formerly Food Stamps), making life harder for the nearly 72 million people who receive health care through Medicaid and 40 million people who get help buying food each month through SNAP.

The budget resolution could make college less affordable by cutting Pell grants, which primarily benefit college students from families who make less than $30,000 a year. School meals for children are also on the chopping block, putting the 23 million children that participate at risk of going hungry.

Even though the Trump administration promised lower prices and to help families make ends meet, these proposals would make it even harder for people to afford the basics. And this additional hardship would be used to fund tax cuts that primarily benefit the wealthy.

Budget resolution will leave everyday Americans worse off, give big tax cuts to the wealthy

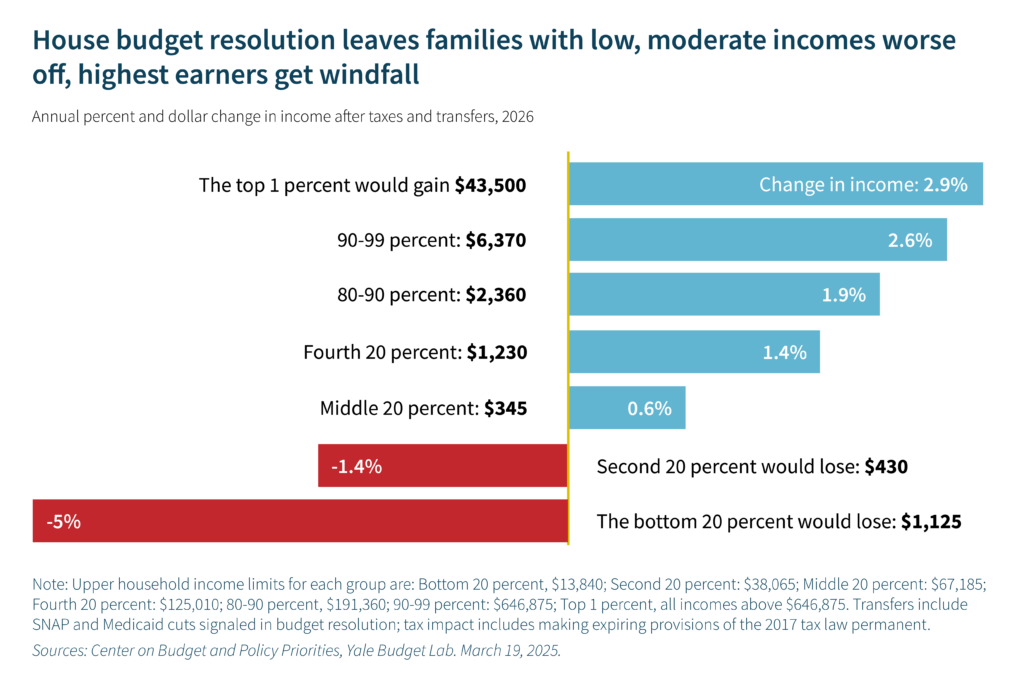

Analysis from the Yale Budget Lab estimates the financial impacts on Americans of different income levels from the major elements of the House budget resolution passed on February 25, 2025. They find that families in the bottom 20 percent of incomes, making roughly below $14,000, will lose an average of $1,125 annually. That is the equivalent of a 5 percent cut to their family incomes after taxes and transfers. The 20 percent of families in the second-lowest income group, with annual incomes of $14,000 to about $38,000, would lose $430. The harm from cuts to food and health care services would far outweigh any meager tax cuts these households would get, leaving them much worse off.

In contrast, high-income households would see their incomes rise, primarily from proposed tax plans. In this analysis, the higher a family’s income, the more they benefit on average. Yale Budget Lab finds that the 10 percent of American households making over $191,000 would gain an average of about $10,000 annually from the budget resolution. The top 1 percent, households making above about $650,000, would gain $43,500 annually.

The tax policies included in Yale Budget Lab’s analysis include permanently extending components of the 2017 Tax Cuts and Jobs Act (TCJA) that impact individuals and businesses. The TCJA was a broad tax package that made permanent cuts to corporate taxes and mostly temporary cuts to the individual income tax; temporary tax provisions generally expire at the end of 2025.

Furthermore, the wealthy could see additional tax benefits not modeled by Yale Budget Lab. Current tax proposals passed out of the House go even further to provide permanent tax cuts to the highest earners than what was modeled in their analysis.

The House budget resolution that passed on February 25 called for $4.5 trillion in tax cuts, which is more than the cost to extend the TCJA.

Tax cuts won’t create shared prosperity

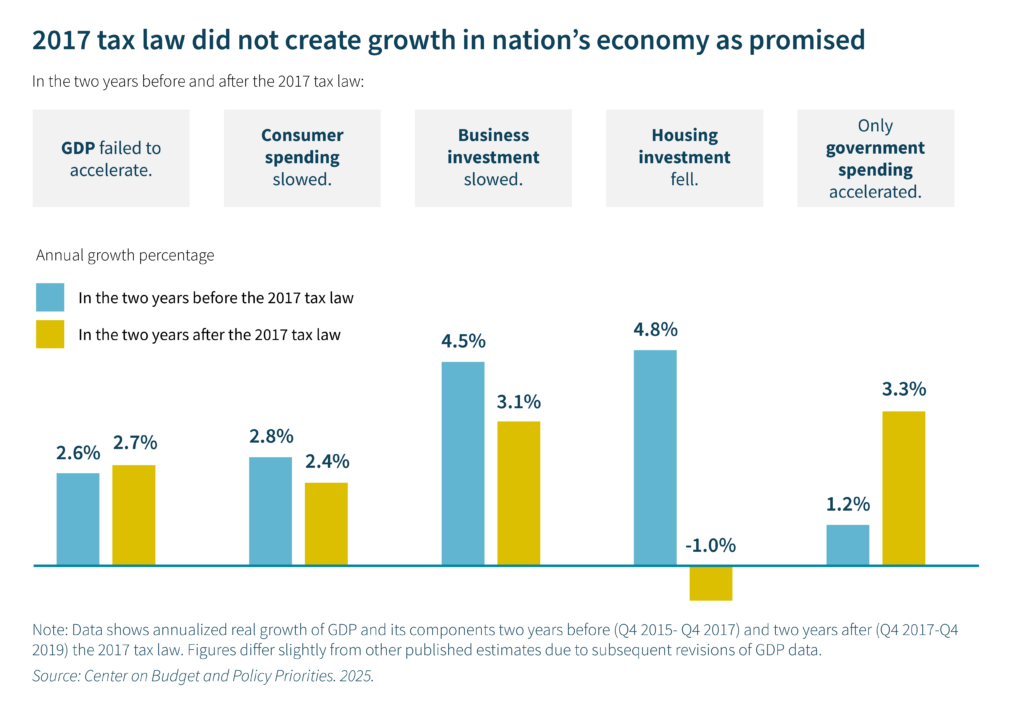

Past experience shows that big tax cuts are unlikely to do much to boost the economy in ways that help the average American. For example, the Trump administration promised the corporate tax rate cut in the 2017 TCJA would lead to at least a $4,000 boost in household income, but in fact, researchers at the Joint Committee on Taxation and the Federal Reserve found that workers in the bottom 90 percent of the income scale saw no changes in earnings.

Promised economic growth did not come from the TCJA, as evidenced by consumer spending and business investment slowing, housing investment falling, and GDP growth not accelerating. There was little additional economic growth in the two-year period after the 2017 tax law was enacted compared to the two years prior to enactment.

Analysis published in late May 2025 from the Penn Wharton Budget Model (PWBM) predicts similarly modest increases in economic growth as measured by GDP from the package of tax cuts and cuts to services contained in the House-passed budget reconciliation legislation (H.R. 1). They estimate that the bill would increase GDP by 0.4 percent in 10 years and the average wage would fall slightly in the first 10 years. Their analysis underlines the evidence gathered after the TCJA became law – that big tax cuts for the highest earners and corporations provide little to no broad-based economic benefits.

Proposed tax cuts disproportionately favor white taxpayers

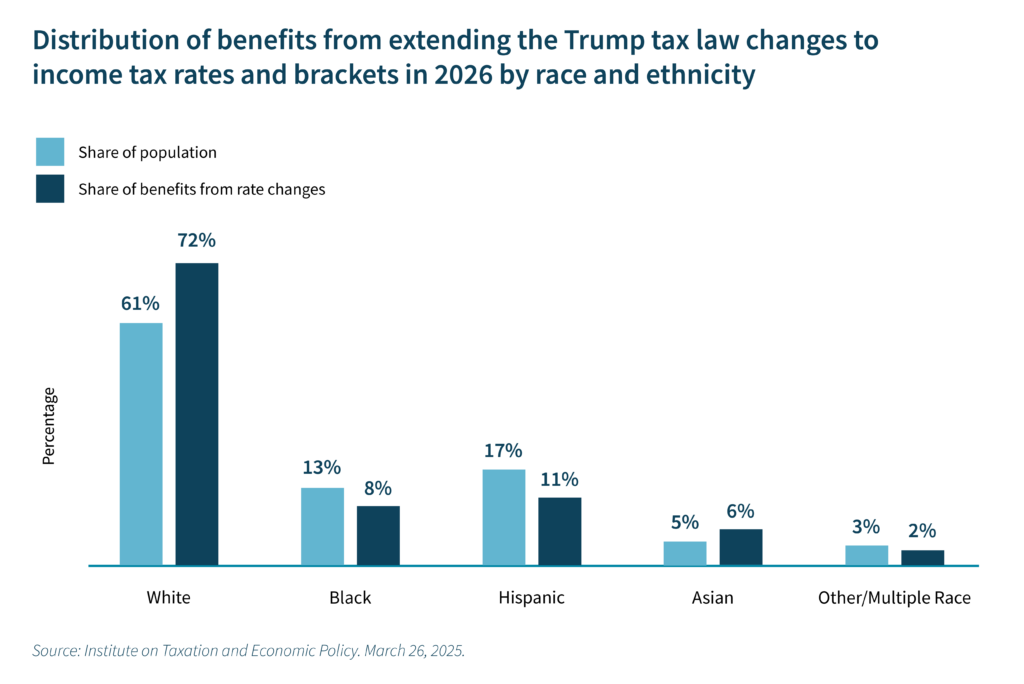

Not only are the proposed tax cuts unlikely to benefit everyday Americans, they are likely to widen gaps in economic well-being based on race. For example, two major elements of the TCJA extension would overwhelmingly benefit high-income, white Americans. These two provisions are continuing the reduction of personal income tax rates and retaining the 20 percent deduction on certain types of pass-through business income.

Pass-through income is often described as “small business” income, but it has nothing to do with the size of the business. Instead, it relates to those businesses that pay taxes on their profits through the individual taxes of their owners, shareholders, and investors, rather than the corporate tax. The TCJA created a new tax benefit that allows taxpayers to exempt up to 20 percent of their pass-through business income from their federal income taxes. Continuing that reduction privileges taxpayers with this particular kind of income, who tend to have higher incomes, over workers who earn their living from wages and salaries.

According to the Institute on Taxation and Economic Policy (ITEP), while white taxpayers make up 61 percent of personal income taxpayers, they would receive 72 percent of the benefits of extending rate reductions and 90 percent of the benefits from maintaining the pass-through deduction.

Meanwhile, in 2026, Black taxpayers make up 13 percent of the population but would receive only 8 percent of the benefits of extending the income tax rates and brackets. Hispanic taxpayers make up 17 percent of the population but would receive only 11 percent of the benefits. In the case of the special tax break for pass-through income, Hispanic and Black taxpayers receive only 5 percent and 2 percent of the benefits respectively.

The results are that people who have been historically deprived of the benefits of our economy and tax code will continue to see little benefit from proposed tax cuts. Black and Latino folks and other people of color face enormous barriers to opportunity, which includes discrimination and disparities in access to education, health care, and employment, resulting in lower income rates. While Social Security, food assistance, tax credits for working families, and other policy choices have done a lot to reduce these income disparities, much more can be done in the tax code to reduce discrimination and build opportunity for all.

Other Trump administration decisions are putting even more strain on the wallets of everyday Americans

Tariffs are tax increases on all of us. Tariffs increase prices for folks across the income spectrum, but they hit folks with the lowest incomes hardest. The Trump administration released tariff proposals on April 2, which imposed a 10 percent tariff on all imports and much higher tariffs on specific countries. According to the Center on Budget and Policy Priorities, adding the cost of the proposed tariffs increases to the tax and budget cuts planned by House Republicans means the lowest income folks would lose $2,270 per year. The 1 percent of Americans with the highest incomes, however, will still get a net increase of $25,500 annually.

Enacting these extreme tariffs will raise the price of basic goods and increase the risk of a recession by slowing down the economy, limiting how much stuff people can afford to buy. As people spend less, more companies look to save money by laying off their workers. Without employment, those workers spend less and add to worsening conditions in the labor market. The brunt of this kind of economic downturn will be borne most heavily by low- and moderate-income Americans.

Everyone is better off when our tax system funds the public goods we all use

Under the proposed budget plans, too many of us would be poorer and less healthy. We are all worse off when folks in our communities are not getting the health care and food they need and deserve to avoid hunger, chronic illness, and even death.

We all – wealthy people and businesses included – benefit from the public goods our tax dollars support. The public roads used to ship goods, the workforce created by our public education system, and the products brought to market as a result of government research are all examples of public goods that benefit us all – and contribute to the success of the wealthiest among us.

The proposed budget plans take from basic needs services to pay for tax cuts that primarily benefit the rich. Americans would be better served by budget, tax, and economic policies that put everyday people first by protecting and strengthening essential public services that our families and neighbors rely on to build healthy, thriving lives and communities.