The state’s economic picture has improved compared to the February forecast, according to the recent April Revenue and Economic Update. While the Update gives reasons to be cautiously optimistic, uncertainty about the pandemic and the economy remain. We also know that many Minnesotans continue to feel the economic fallout from COVID-19 as well as the deep impact of racism in our economy and institutions. Some of the top takeaways from the Update include:

1. State general fund revenues to date came in higher compared to the February forecast. Revenues for February and March 2021 came in $563 million – or 20 percent – higher than the earlier projection. Corporate and individual income tax revenues were the largest sources of this increase. However, the Update notes that it is still too early to say whether these increases are due to improvements in incomes and corporate profits. Changes in tax-filing deadlines are one of the factors making it more difficult for forecasters to extrapolate whether this data reflects an improving trend or timing issues. In addition, the state has received additional tobacco settlement revenues that are now included in the budget baseline.

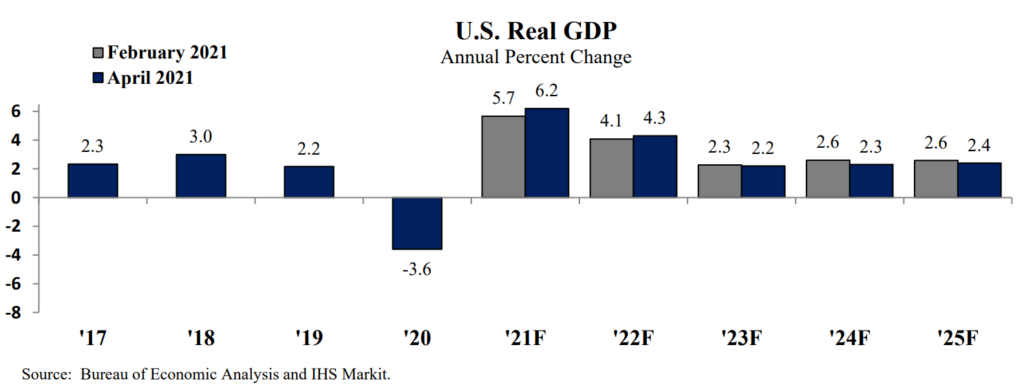

2. Near-term economic expectations are somewhat improved. After a 3.6 percent reduction in the nation’s GDP last year, the economic forecasters now predict 6.2 percent growth in national GDP in 2021. That’s stronger than the 5.7 percent projected in February. This stronger projection is largely due to increased consumer spending and a faster vaccination rollout. Forecasters have dialed back their projections for economic growth in 2023 to 2025, when growth rates a bit above 2 percent are expected.

3. Unemployment is expected to decrease over the course of 2021, but many people are still out of work. This March, the national unemployment rate was 6.0 percent, down from the peak of 14.7 percent in April 2020. IHS, the state’s economic forecasters, expect U.S. unemployment will further decline to 4.3 percent by the end of 2021. However, this doesn’t mean the labor market has fully rebounded. The unemployment rate doesn’t capture those who have left the labor force during the pandemic – for example, workers who have stopped looking for work for now. The national labor force participation rate in March was nearly 2 percentage points lower than it was a year ago.

4. Forecasters are only somewhat confident in their projections. The nation’s economic performance is dependent on the severity of the pandemic and the effectiveness of efforts to bring it under control. Uncertainty about the course of the pandemic is reflected in forecasters’ uncertainty about their economic projections. They assign a 50 percent chance that their baseline economic scenario is correct. They give a 25 percent chance for a more pessimistic scenario in which the pandemic causes greater economic harm, and a 25 percent probability to a more optimistic scenario in which the impact of COVID-19 is less severe.

Our take on what this means for budget and tax decisions this session

The April Update provides some updated information about the state’s budget and economic landscape, but the February Forecast remains the reference point that policymakers will use to understand what resources are available as they craft the state’s next two-year budget. While there are signs of improvement, the Update also is clear that the economic damage of the pandemic is far from over.

The federal government’s recent American Rescue Plan included important economic supports for individuals and families and essential additional funding to bolster services provided by state, tribal, and local governments. The April Update’s economic growth projections reflect the current and anticipated impact of this stimulus bill – a larger one than was anticipated in the February Forecast – but these additional federal dollars are not incorporated into the general fund revenues reported in the April Update.

These federal funds provide an important source of resources to take action to advance Minnesotans’ health and well-being through investments in things like our schools, affordable housing, health care, a more equitable justice system, and support for BIPOC-owned businesses. Policymakers must intentionally address the state’s deep divides in opportunity and well-being across race, income, and geography. Passing a “status quo” budget that leaves systemic barriers in place is not acceptable.

However, the additional federal funding is temporary; policymakers should look to maintain needed investments by raising additional revenues from those with the greatest ability to contribute a bit more.